The finance industry has undergone a digital transformation. For decades, institutions have been our most trusted financial advisors, but the rapid rise of FinTech has allowed us to take matters into our own hands— literally. Through mobile smartphone apps, FinTech offers consumers new levels of access, power, and control, and as a result, they are now re-writing the traditional rules of finance to work in their favor.

FinTech also creates new opportunities for financial inclusivity. By providing everyone equal access to products and services, FinTech aims to right the wrongs of the past and level the playing field for the future. But while these messages of empowerment, equality, and self-reliance resonate with today’s consumers, this new world of digital finance remains mostly unknown.

To better understand how the finance industry is evolving, Vox Media partnered with Woo Brand Research on a survey of over 3,000 general consumers. 85% of those surveyed feel that technology has made it easier for them to access their financial information, and 82% believe technology has given people the confidence to take control of their finances. Still, overall usage on mobile finance apps remains low (with the finance-savvy Vox Media consumer being the exception to the rule). Now is the time for brands to build meaningful relationships with consumers and help guide them on their path toward financial freedom.

Here’s our rundown on how consumers are shaping the new financial future.

APPS ARE THE FUTURE

Right now, 68% of consumers do most of their banking online. However, there is a growing desire to do more from their phones; in fact, over half (53%) say they would prefer to do all their banking on their smartphone if they could, and 52% say they would use their mobile phone to pay for everything.

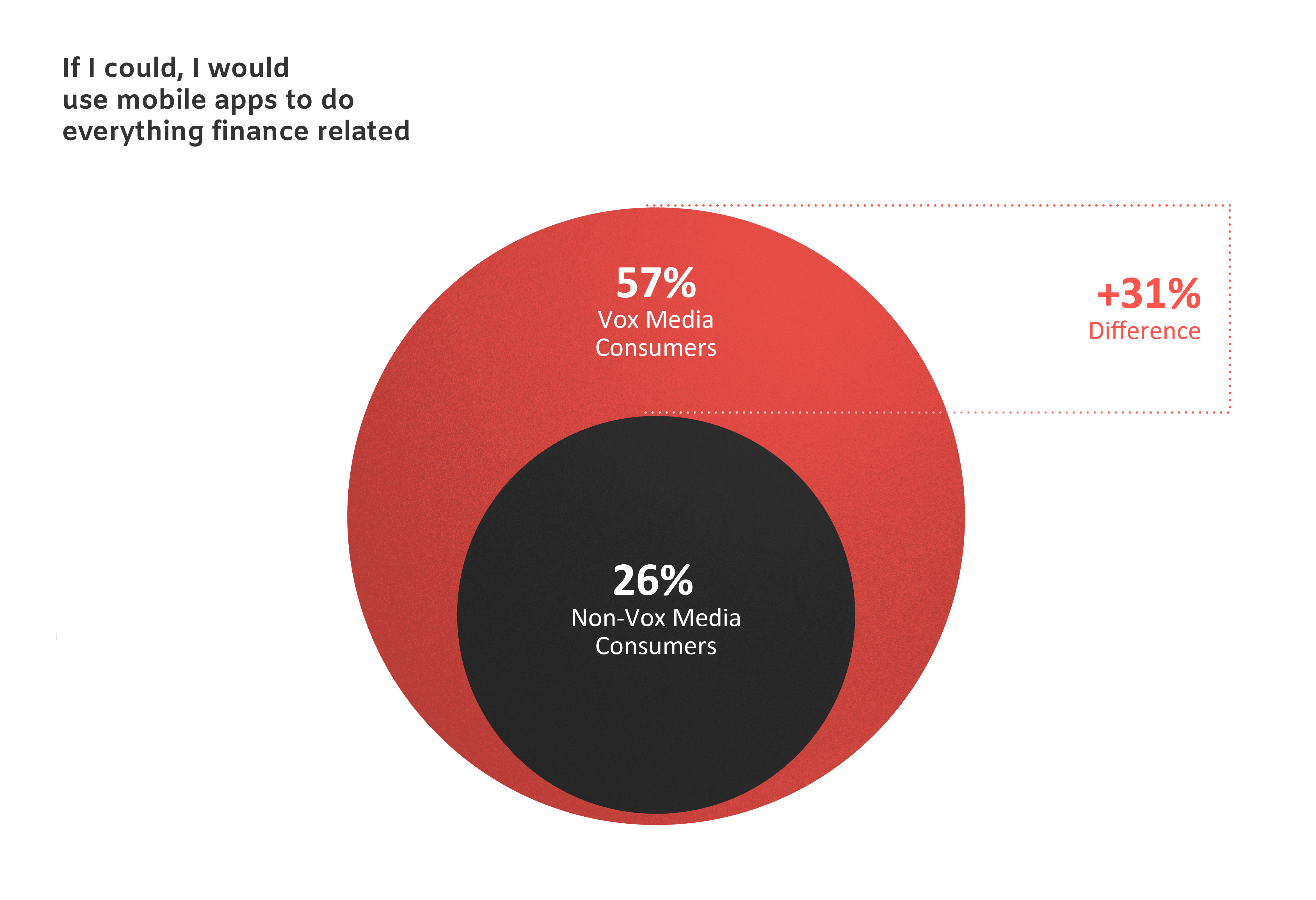

This desire, coupled with last year’s increase in finance-related mobile app installs, highlights the integral role apps will play in our financial futures. Because our phones are always close by, apps provide the accessibility and control to easily manage our finances anytime, anywhere. We already see 41% of consumers saying that if they could, they would use mobile apps to do everything finance-related.

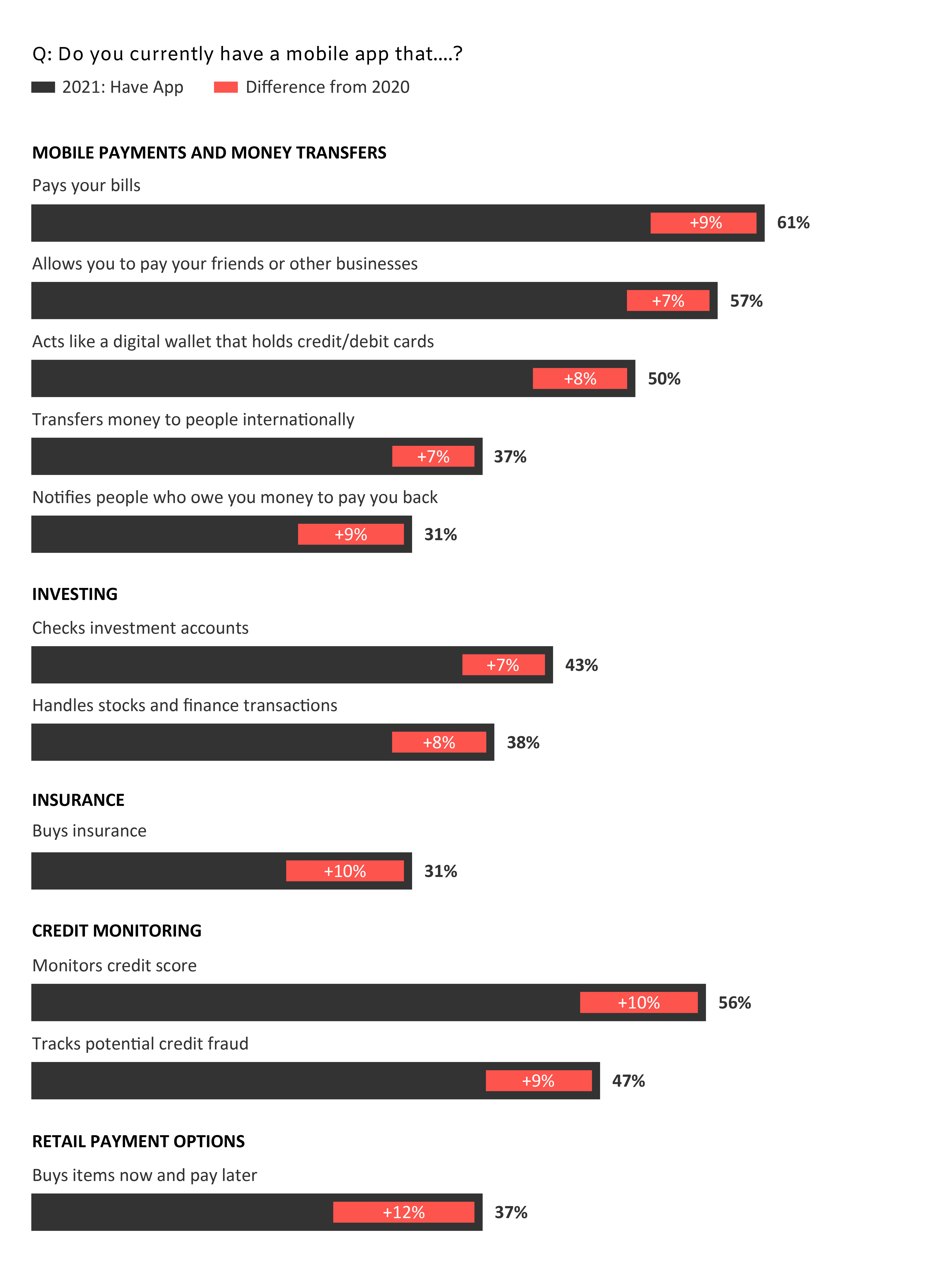

Some key trends among apps:

- Among the categories we tracked, we see just about all mobile app installs increasing from a year ago— a sign of their growing popularity.

- While the percentage of apps installed for bank and savings accounts from traditional institutions like Bank of America, Chase, Citi, etc, remained the same, they continue to be the most-installed type of app for finance management.

- While app installations continue to trend upwards, their actual usage remains low.

- Right now, more than 50% of consumers have mobile apps for banking, personal wealth management, and digital payment.

- Credit monitoring apps are also becoming more popular, with the expectation that they will continue to grow at a high rate given the increase of data security breaches.

- Falling in the middle are mobile apps used for investing, Buy Now, Pay Later (BNPL), loan acquisition, and buying insurance, at about 30-40%.

- Real estate and investments currently fall at the lower end, with just over one-fourth having these types of apps. However, there is great potential based on the current real estate market.

- Among consumers who do not currently have a mobile app installed for any one of these categories, on average, about one-fourth say they are open to getting them in the next year.

- Millennials are most likely to have a financed-related app installed for each of these categories, followed by Gen Z.

- Gen X are currently using mobile apps mostly for banking, digital payments, and credit monitoring, but based on their age and earning power, investing in this group makes fiscal sense in the other categories as well.

EDUCATION CAN HELP CONSUMERS BUILD CONFIDENCE

While installations of finance apps continue to rise, as of now, only half of consumers understand how to use them. In order to grow the market, companies (both old and new) must first commit to educating consumers on the benefits and advantages of their apps over traditional products and services.

Only 47% of those surveyed say they are comfortable using apps to manage their financial portfolios. For the rest, learning more about the inner workings of these apps, including their benefits and security parameters, can help alleviate current insecurities.

Marketers should be cognizant of the fact that how they market to each of the generations may involve a certain level of customization, particularly for Gen Z and Gen X. We say this because:

- The “newbies’’ among Gen Z are, for the most part, at the beginning stages of building their financial portfolios. As true digital natives, they don’t need guidance on how to use finance apps, but they do require education about what the apps do and how they can benefit from them.

- Gen X have had many years of practice managing their finances, but mostly through traditional products and services. In order to capture Gen X’s attention, marketers should focus on helping them transition from the past to the present, including education on the benefits of apps to their financial security and safety.

LOYALTY IS FLEETING, AND NO BRAND OR COMPANY IS IMMUNE

Consumers are making financial institutions work harder than ever before for their business and loyalty. As new disruptive companies enter the market and offer consumers more choice, big brands that once dominated the industry are no longer safe. Consumers demand innovation and will not hesitate to switch brands if they find something better.

- 41% feel that more established financial institutions are not offering enough new technology products and services.

- 39% say they are not loyal to any one mobile app brand and they will switch if they find something better.

- 32% prefer to support new and upcoming mobile app brands vs. those that have been around longer.

BANKING VS. INVESTING AND PERSONAL FINANCE MANAGEMENT

Despite the learning curve, consumers are more familiar with banking apps than they are with investing and personal wealth management apps, which translates to a much higher installation rate.

Familiarity with how apps work

Low familiarity also translates to overall low awareness for most of the newer FinTech brands. Chime and Robinhood have the highest awareness, but even so, app install is low (17%) for both. Brands like Greenwood and MoCaFi, created specifically to address the inequalities of the financial industry, are not well-known. Overall, more than 50% say they don’t even know the names of the newer brands listed. Even as FinTech gains popularity, there’s still a need to grow overall awareness.

MOBILE PAYMENT APPS

However, most consumers do know about — and are currently using— mobile payment apps, which have accelerated in growth due to the pandemic. As digital and contactless payments become more common and mail delivery continues to experience nationwide delays, demand for these apps has skyrocketed. Furthermore, many people have been financially impacted by the pandemic, so they may be attracted to new payment options for purchases like Buy Now, Pay Later (BNPL).

Still, not every brand is well-known. Venmo, Zelle, and Cash App have the highest levels of awareness, but their app installs are not at the level of PayPal, which is the preferred payment app of most consumers. 50% have not yet heard of these newer brands.

I am familiar with how payment apps work…

Familiarity with Payment Apps

INSURANCE AND LOAN MOBILE APPS

About half of consumers say they are knowledgeable about insurance and loan mobile apps, including usage, products, and services, but only a third feel compelled to use them. As such, awareness is not necessarily translating to interest, and there may be additional hurdles to face when compared to other types of finance-related mobile apps.

Familiar with How App Works

It’s not surprising that older and more established brands have stronger brand awareness, with most consumers having heard of them; but they are not rushing to install these apps either. Awareness for newer brands in the loan and insurance categories remains low.

Lack of trust may be to blame for the slow transition to mobile apps in these categories, as only about a third of consumers believe them to be trustworthy.

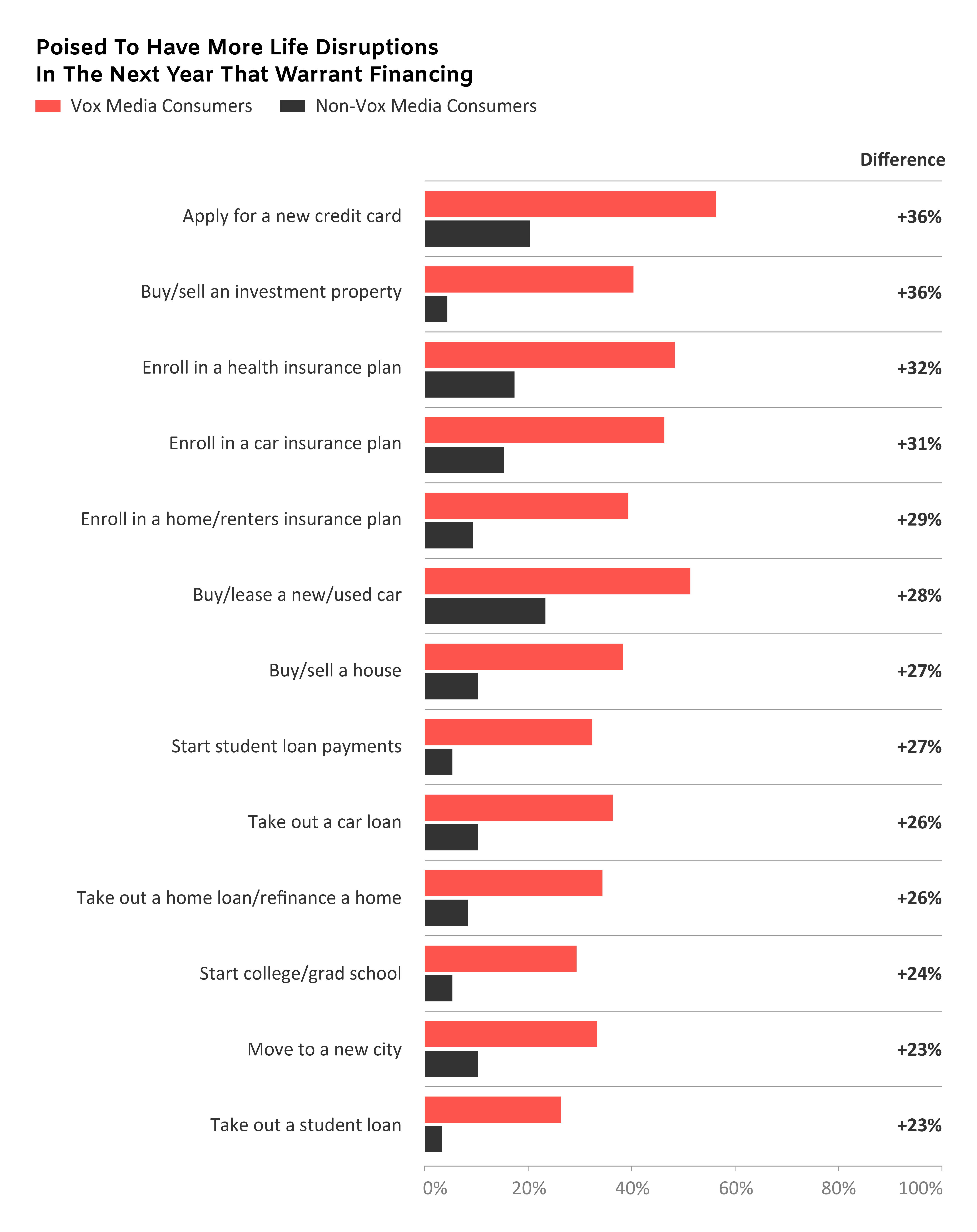

There may also be a greater demand for more loans and insurance products and services as consumers plan to make big life changes in the next year. This provides opportunities for brands to leverage these types of apps to meet consumer demand— but they must start preparing now.

- 37% plan to buy or lease a used car

- 33% plan to enroll in a health insurance plan

- 31% plan to enroll in car insurance plan

- 24% plan to take out a car loan

- 24% plan to enroll in a home/renters insurance plan

CRYPTO REMAINS A MYSTERY TO MOST

Since its introduction to the market, people have been fascinated by cryptocurrency— but consumers in general have still not fully embraced it. Our data shows that only about 31% have bought crypto at some point since its first availability. However, we are seeing a surge in interest and purchase of crypto within the past year, possibly driven to some extent by the pandemic.

In fact, 66% of current crypto purchasers say they only began investing in cryptocurrencies within the past year. As a result, we are seeing the dynamics of who is investing now shifting, with more Gen Z-ers dabbling in the crypto market.

Still, overall awareness remains low; that’s not surprising, as crypto investors are only a small part of the population. Bitcoin (58% awareness) is the most well-known cryptocurrency, but in general, more than 60% of those surveyed remain unaware of the cryptocurrencies available to them. Because most people are not fully grasping what cryptocurrency is or what it does, education will be a crucial first step in driving interest.

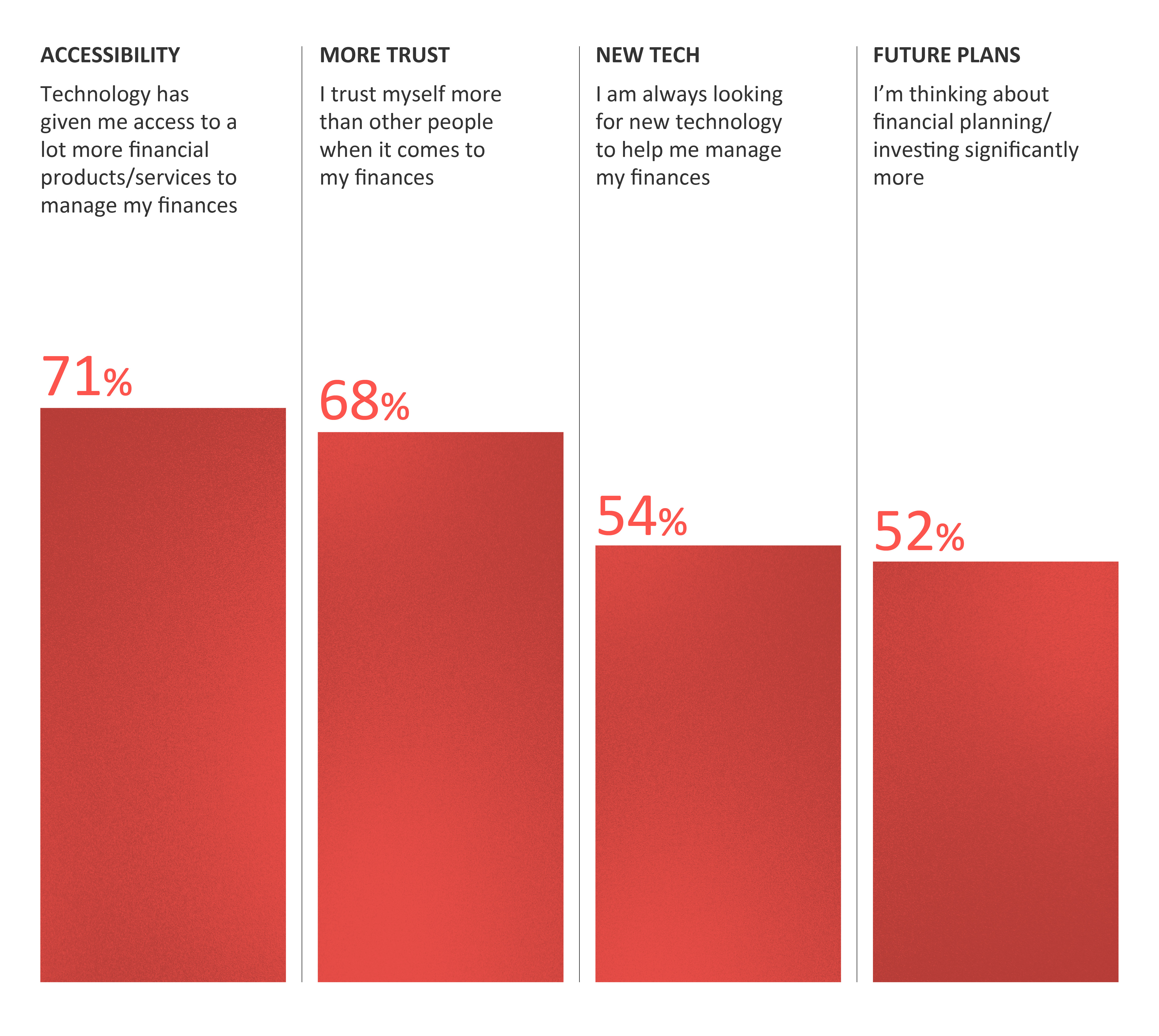

VOX MEDIA CONSUMERS ARE CONFIDENT

Unlike the general population, the Vox Media audience is made up of financially minded consumers who are already using many finance-related mobile apps. They are also more confident in their skills to leverage these apps to their advantage.

If given the opportunity, Vox Media consumers would use their apps and mobile devices to manage all their finances; as a result, brands will have fewer hurdles to overcome with this audience.

THE INFLUENCE OF VOX MEDIA CONSUMERS

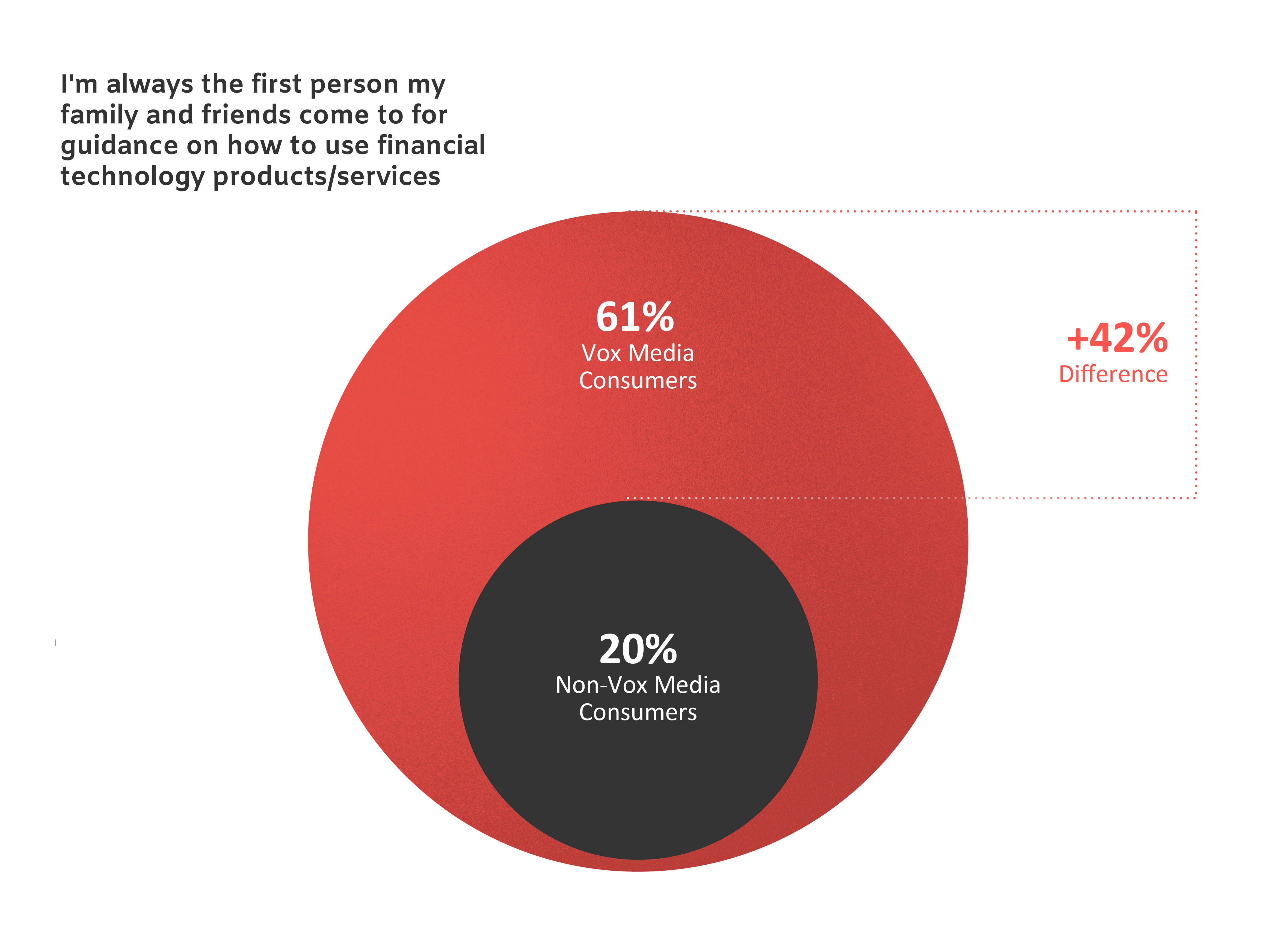

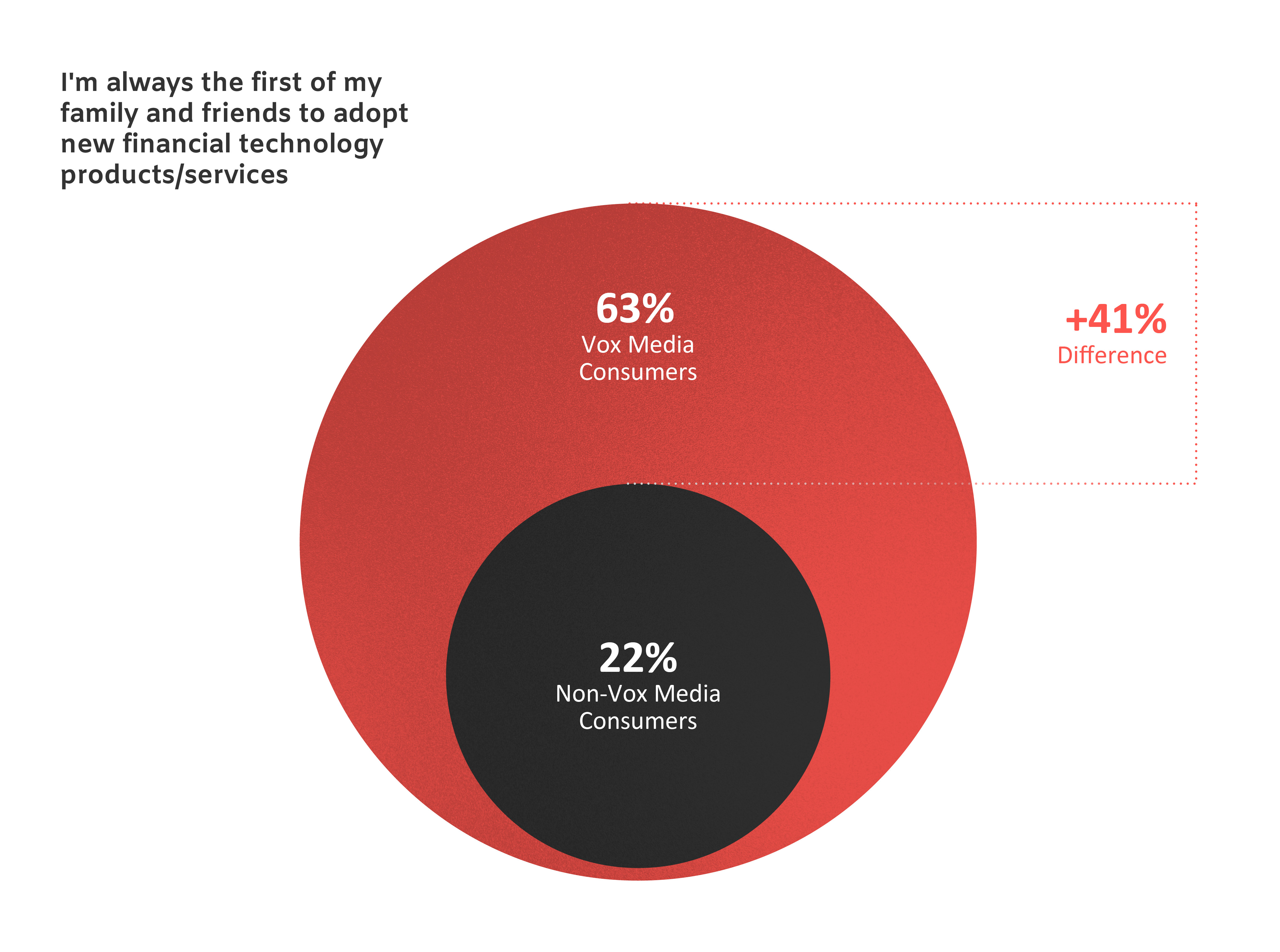

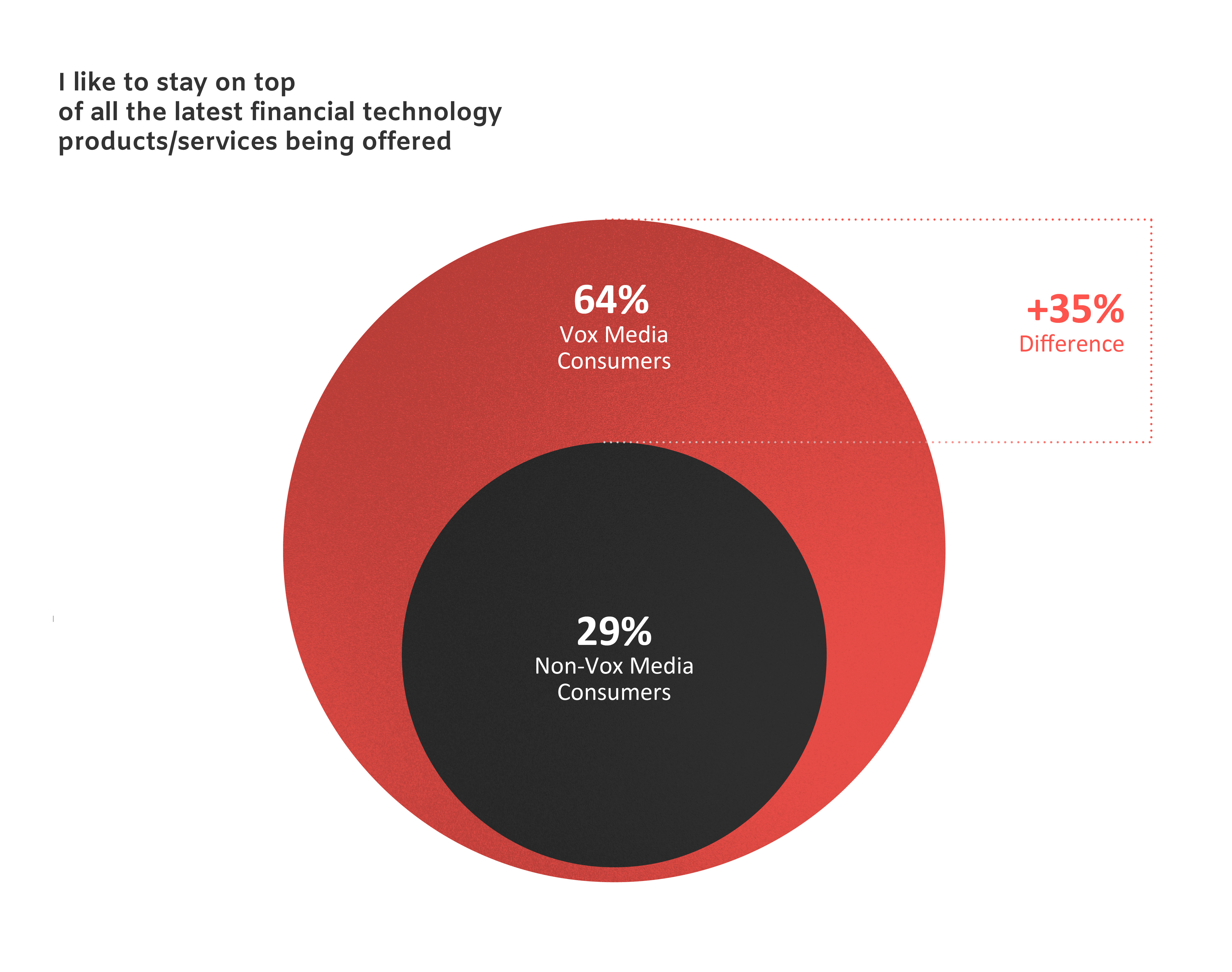

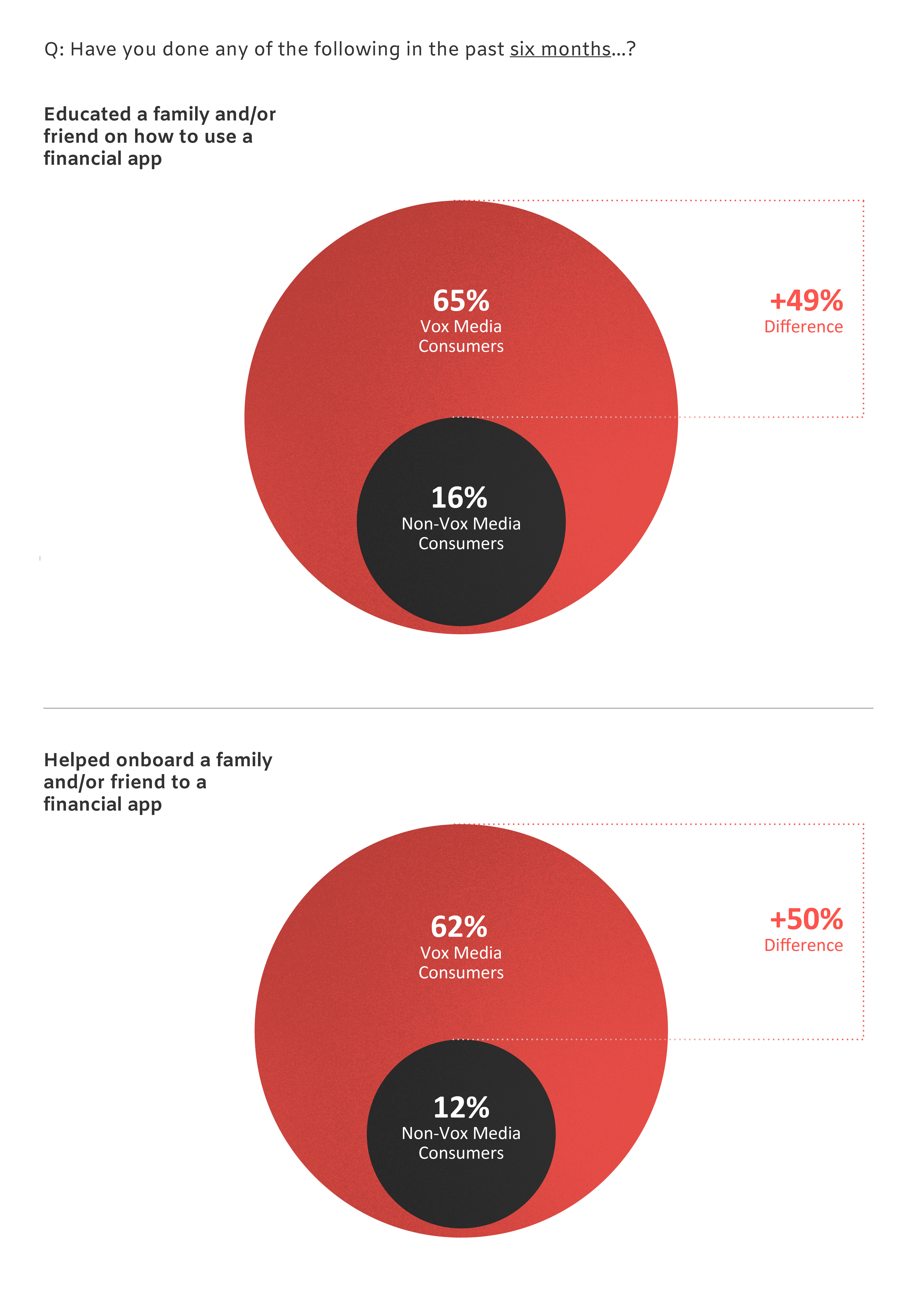

In fact, Vox Media consumers are so financially savvy, they act as personal financial advisors to family and friends (but without the pay, of course). Among their inner circles, they are seen as the “go-to” people for trusted advice and recommendations. Given the influence of the Vox Media audience, brands will be able to leverage their power to drive business growth through word-of-mouth.

INFLUENCE LEADS TO ACTION

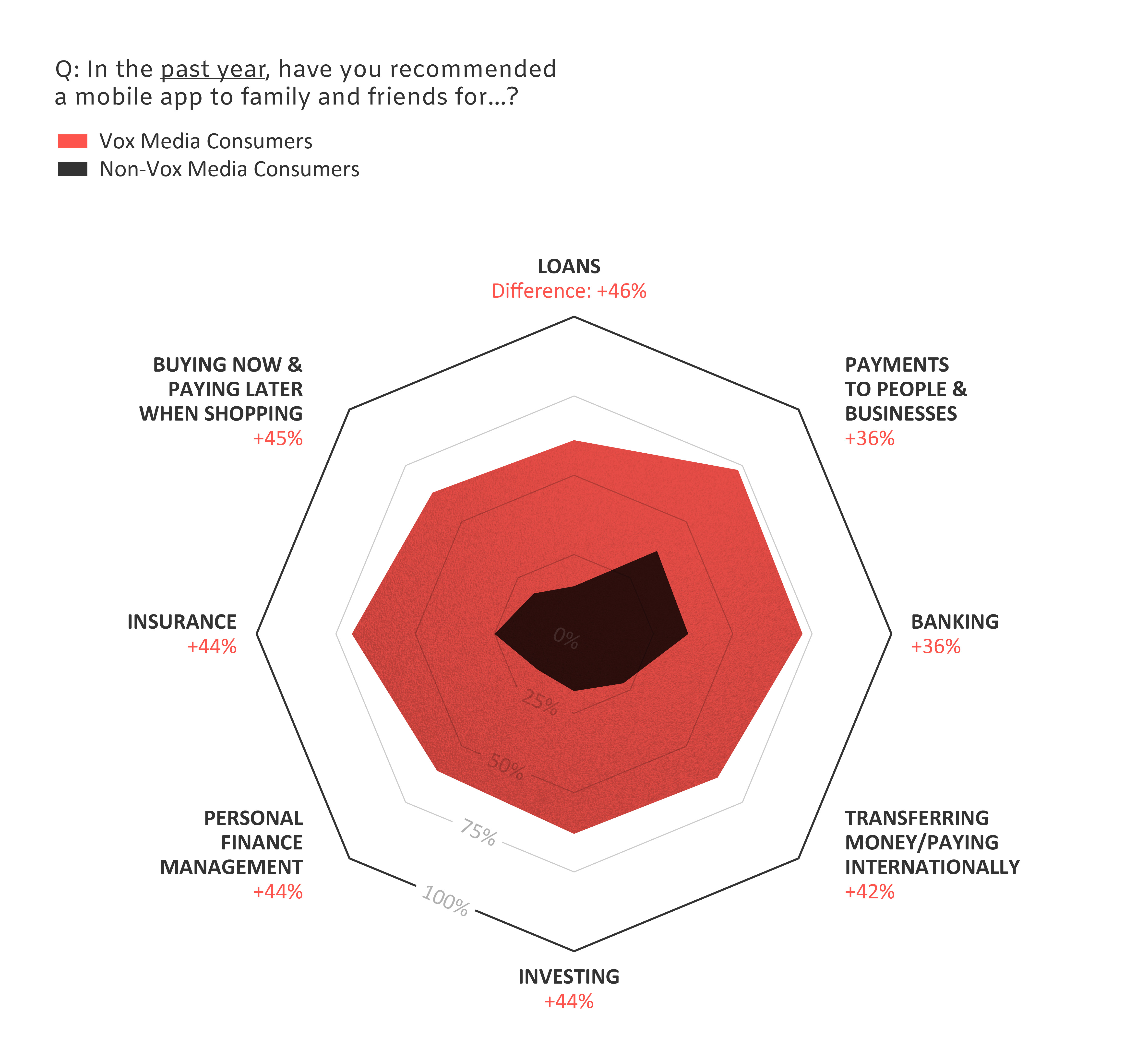

Vox Media consumers are far more likely to have recommended a finance mobile app to family and friends in the past year AND helped educate them on usage. They are always looking for new, innovative technology to help them improve the management of their finances, and they leverage digital channels as sources to see what new products are out there. It’s clear that brands are more likely to get noticed by Vox Media consumers.

Q: In the past year, have you recommended a mobile app to family and friends for…?

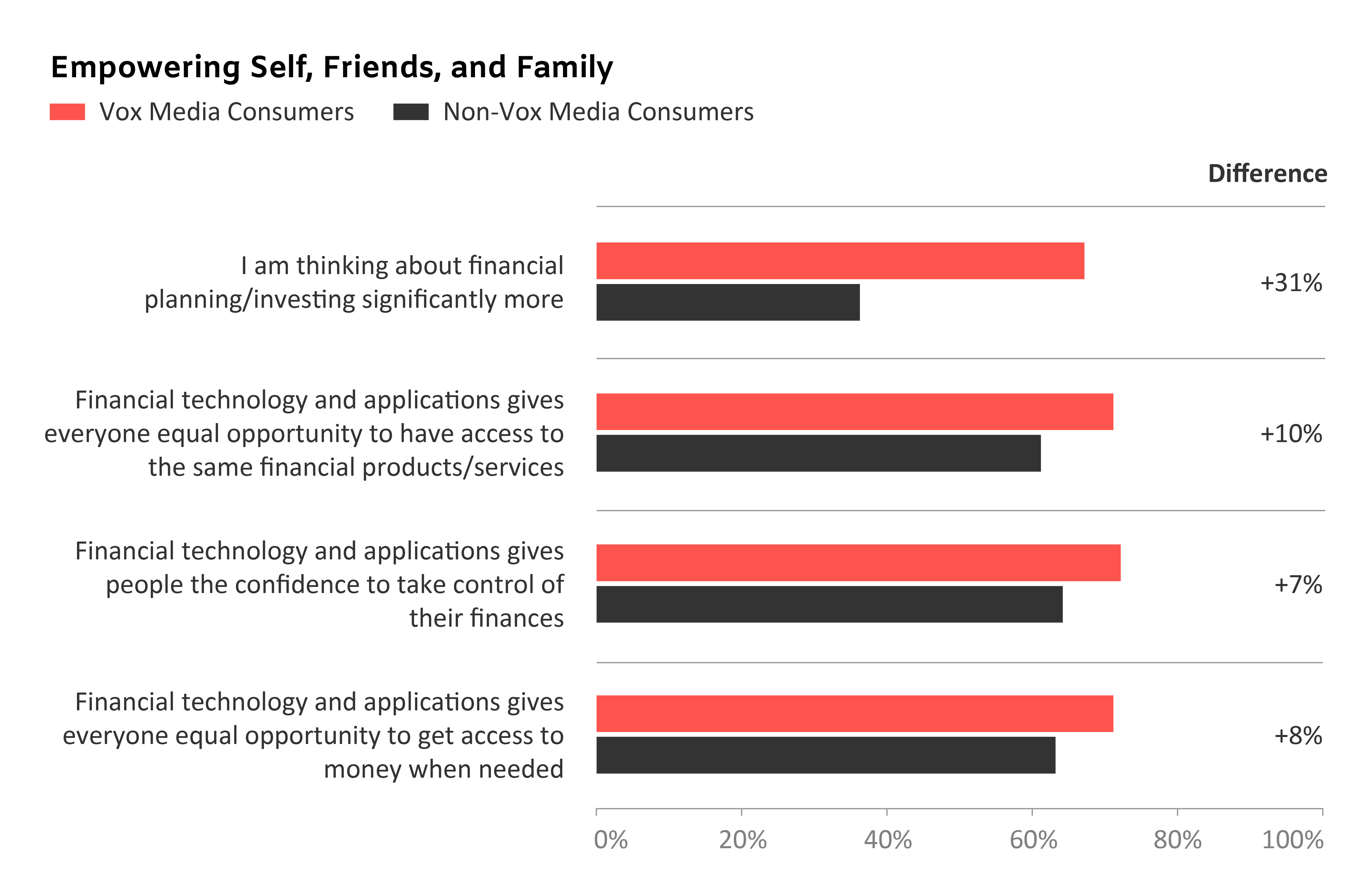

EMPOWERMENT AND EQUALITY

Vox Media consumers care a lot about their personal finances, but they are also invested in the financial health of others. Empowerment and equality for all are messages that truly resonate with them. This is top of mind when deciding which brands to use and recommend to family and friends.

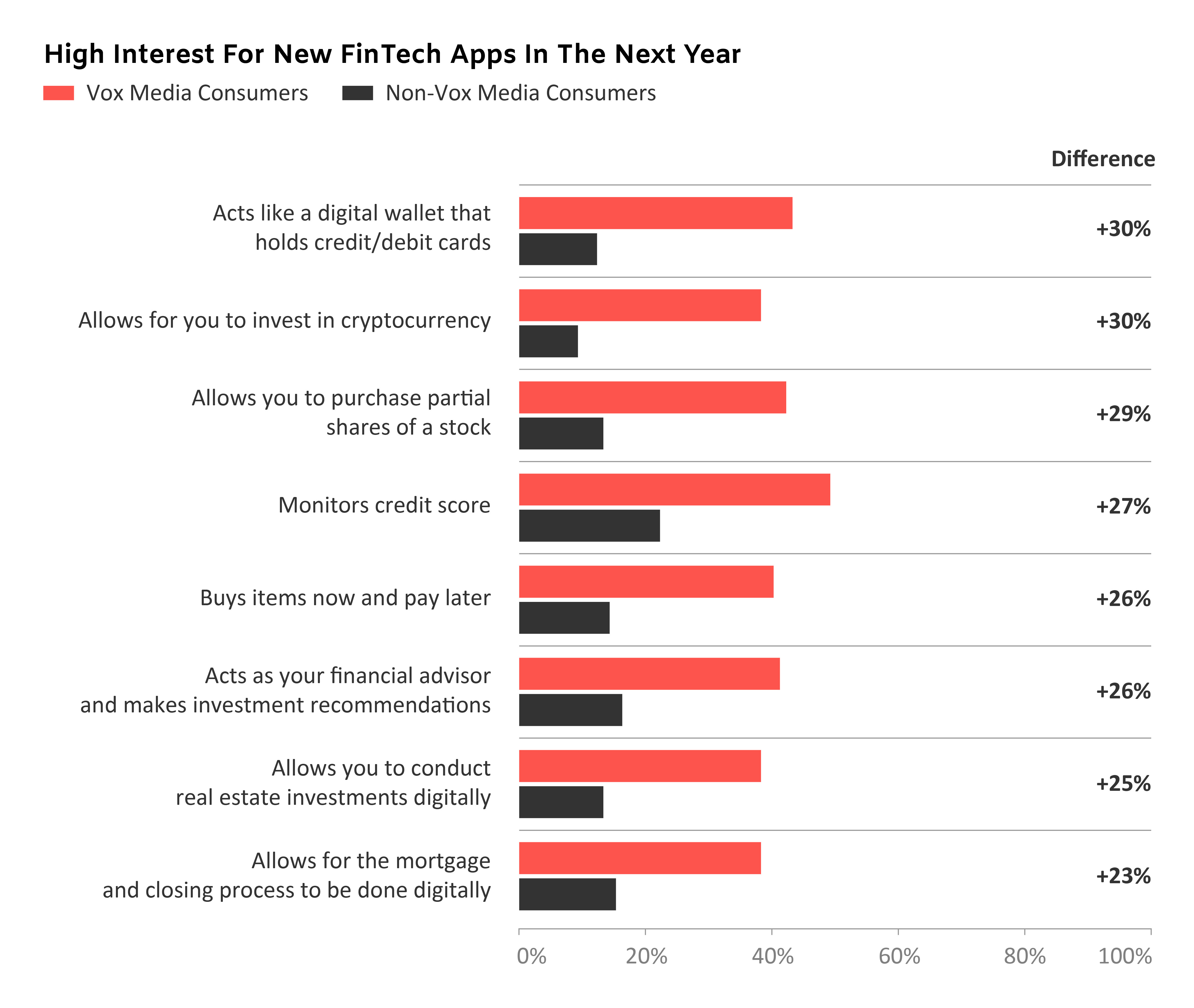

HIGH INTEREST IN NEW FINTECH APPS

For the Vox Media consumers who aren’t using finance apps, there is a higher affinity and interest in installing one within the next year; they are much more interested in mobile apps for payments, investing, and wealth management than non-Vox Media consumers.

They also plan to make many major life changes in the next year that will require finance-related products; as we know, they are more open to using apps to help them along the way.

In just a few short years, FinTech has already made a huge impact, and has the potential to completely revolutionize the finance industry. The pandemic has helped consumers connect with new technology and services, and they are seeking them out more than ever before.

But in order to truly accelerate FinTech’s growth, marketers need to develop messaging that explains how and why their apps are the way of the future. Consumers may not fully understand all that FinTech can do, but they do understand that the power is in their hands.

Contributors: Edwin Wong, Margo Arton, and Loren DiBlasi

Woo Brand Research is an insight and strategy consulting agency specializing in helping brands understand the consumer mindset and shopper journey in the digital age. We develop custom quantitative and qualitative research to understand consumers from all angles including generational trends to effectively develop marketing communications and campaigns and brand positioning.