As we round the corner on the pandemic and continue to make progress toward solving the many challenges of the last 15 months, marketers will need to acknowledge the role empathy plays in the reopening. While there is strong hope about re-emergence, it’s important for marketers to understand that because of the pandemic we have all experienced collective loss that we will need to continue to cope with in order to create a more resilient society.

Brands need to understand consumers’ path to a post-pandemic life, with acknowledgement of loss in their messaging in order to connect with consumers.

Working with SightX & ATCS Insights, we surveyed ~2,500 people & studied social conversations and found that:

- As a society, we share a common bond through loss and coping, and only after understanding that can we speak to re-emergence

- A healthy understanding of coping can be used by brands and publishers to play a key role in rebuilding a healthier and more resilient society

- Understanding what consumers want from brands is critical for how to message and what to message

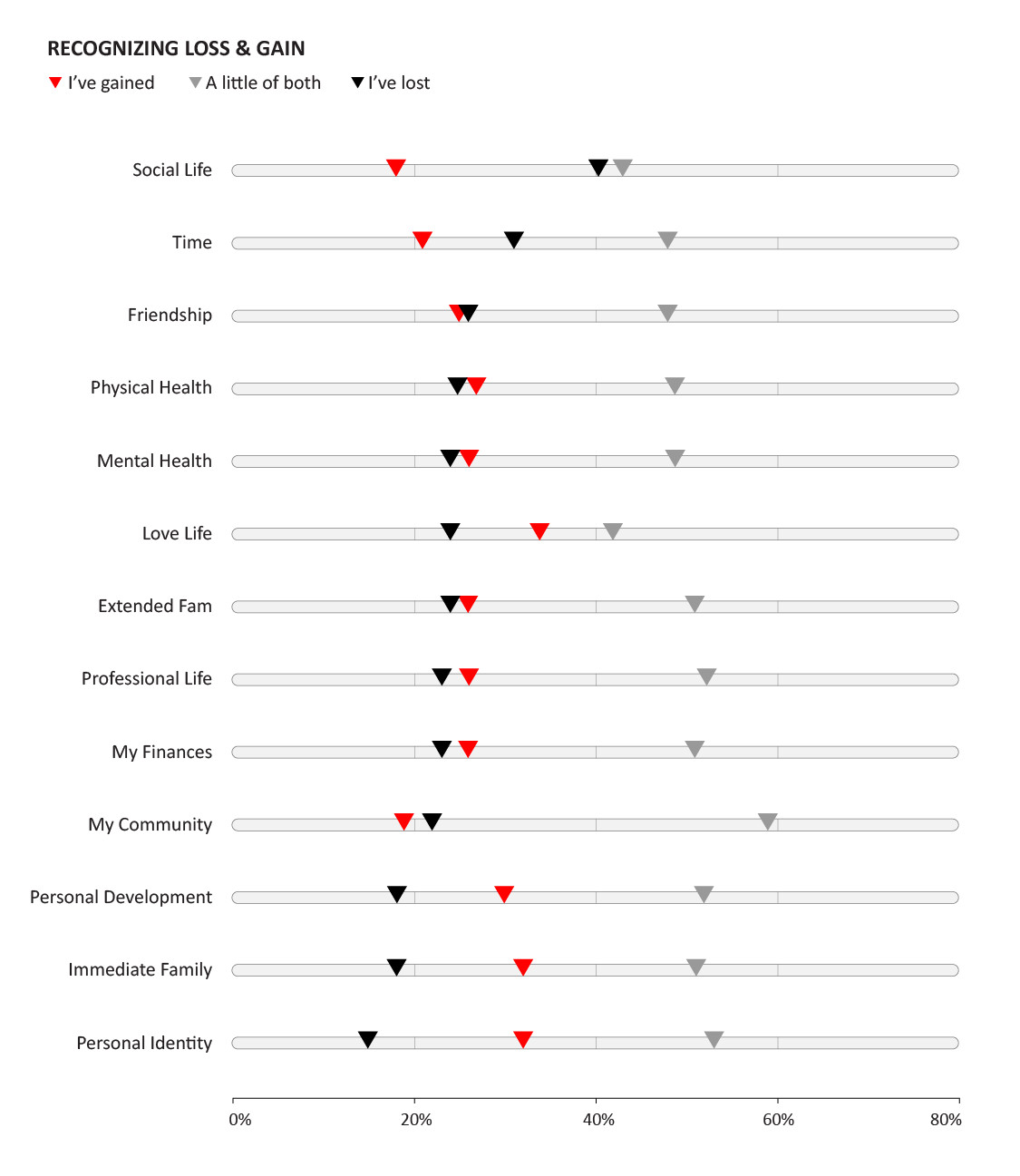

RECOGNIZING LOSS & GAIN

Many of us have spent years in marketing thinking about brand building, inspiration and aspiration. But as we discuss “what’s next” for marketing, today’s consumers are increasingly looking to brands for messaging that acknowledges our collective experience, including hardships, during the pandemic. With that knowledge, there is nothing more authentic and important than understanding the consumer through the lens of loss, coping and resilience. Adam Grant wrote a salient article about how we all feel like we are “languishing,” and the belief that if you don’t understand what someone has lost, you can’t inspire them to re-emerge feeling better.

In our work, we found that the vast majority of consumers, three-quarters, stated that this year brought some form of loss. On average, a consumer stated that they experienced loss in three areas. Here’s how the data fell out:

People felt the most loss around time, connection, and their own health. Right now, people also feel closer to their families and have actually gained a greater sense of personal development and identity.

HOW LOSS IMPACTS CURRENT MINDSET

66% state that they currently feel negative, choosing words like “tired,” “frustrated,” and “tense” to describe the moment. We worked with research firm ATCS Insights and found that in early March 2021, there was a significant spike in social conversations around the concept of “pandemic numbness” on Twitter. At that time, consumers reacted to the excessive exposure to news around Covid-19 deaths by creating an emotional disconnect from the pandemic. People found it more difficult to focus, be creative, and live productive lives. As we re-emerge, this mindset of loss is important for marketers to recognize because we found audiences to half strongly believe life will “continue to be hard (46%)” with the added “pressure of going back to life as it used to be (45%).”

THE IMPORTANT ROLE OF COPING

Understanding loss is a start, but shifting the focus to coping is even more critical. When we choose to embrace this nuance, we start to understand the consumer more fully, which actually unlocks our ability to powerfully market.

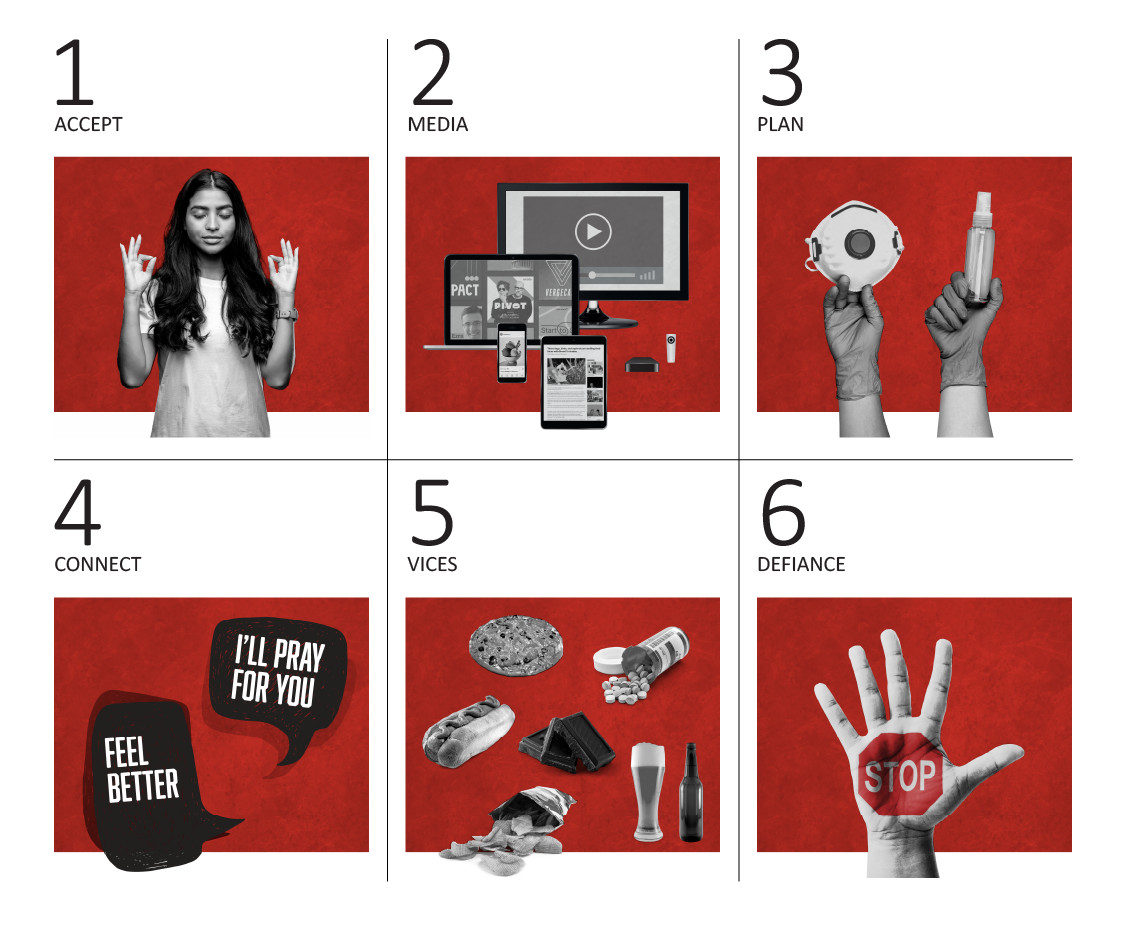

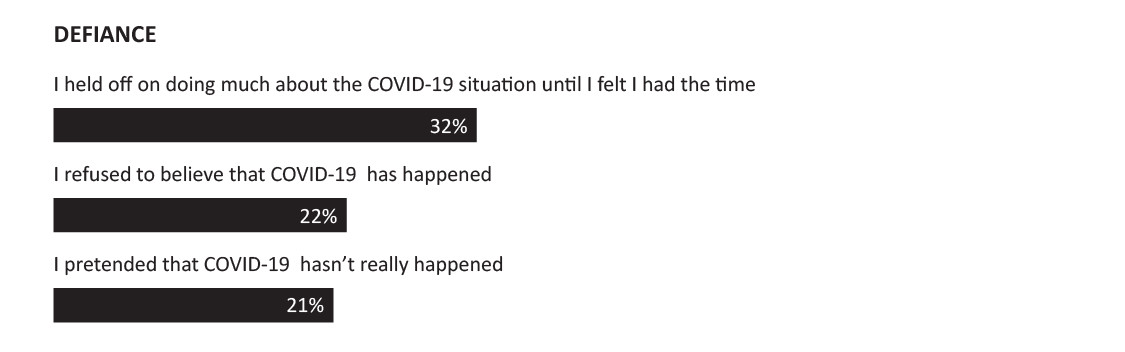

We utilized a well-defined psychological model, the Coping Circumplex Model, to understand how we are all coping with loss. The model is based on the assumption that individuals in stressful situations face two tasks: they need to solve the problems created by loss, and regulate their emotions during a tough time.

We found that the experience of loss actually trumped the loss of something itself. In fact, regardless of the type of loss experienced, there was absolute consistency to how we coped. Further, if we experienced either a loss OR a gain, we had higher scores in coping than those who didn’t lose or gain at all.

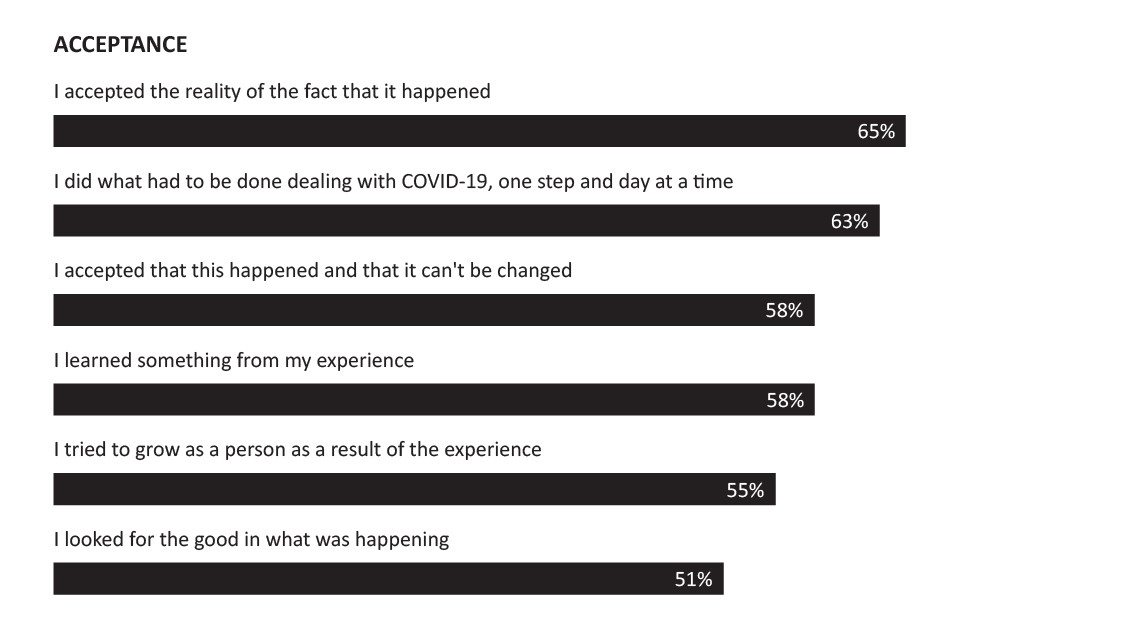

Using the Circumplex model, we saw that most consumers used “acceptance” to cope, followed by media, then planning. They also turned to connection with others, indulgences such as food and alcohol, and denial of the pandemic itself, though less frequently.

ACCEPTANCE & LEARNING

The first phase with any type of loss is acceptance, then learning. Consumers showed a surprising amount of resilience, with about ⅔ hoping to learn and grow from the experience.

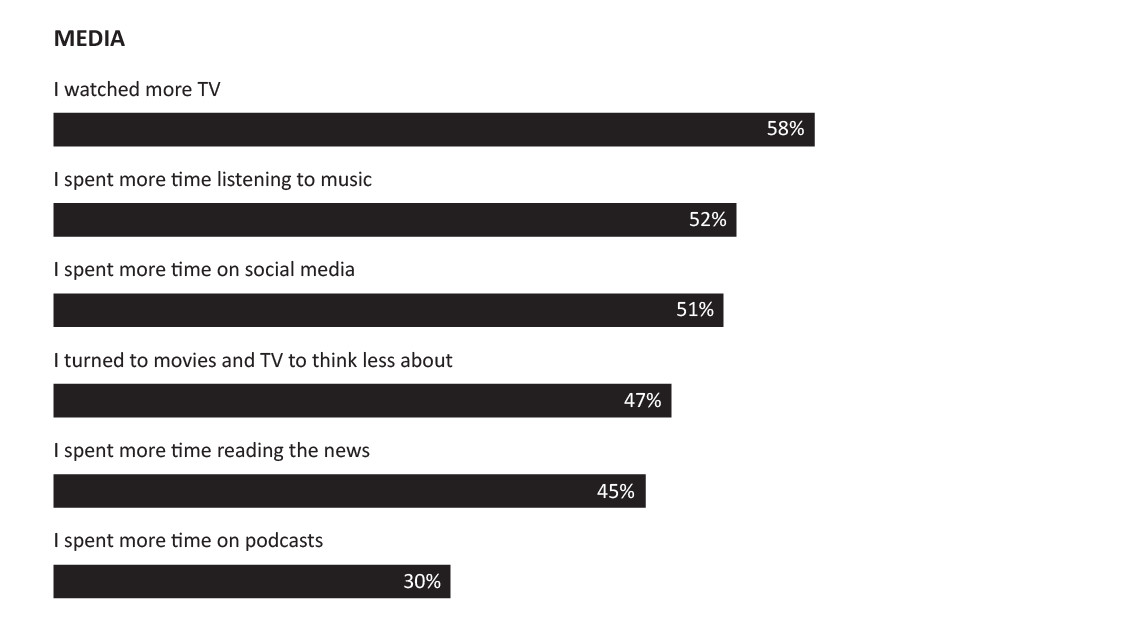

MEDIA, A CRITICAL ROLE WITH COPING

Within the psychological model, we sought to understand the tools one might use to cope. We hypothesized that some would use media, some would turn to food, and others would turn to vices like drugs and alcohol.

We found media was one of the major and most significant tools used to cope. We escaped through TV, music, and social media connections, and gathered important information from news and podcasts.

As marketers continue to contemplate responsible media, this data reinforces the ability brands have to be present, take part in, and even sponsor the activities happening around media as a coping tool.

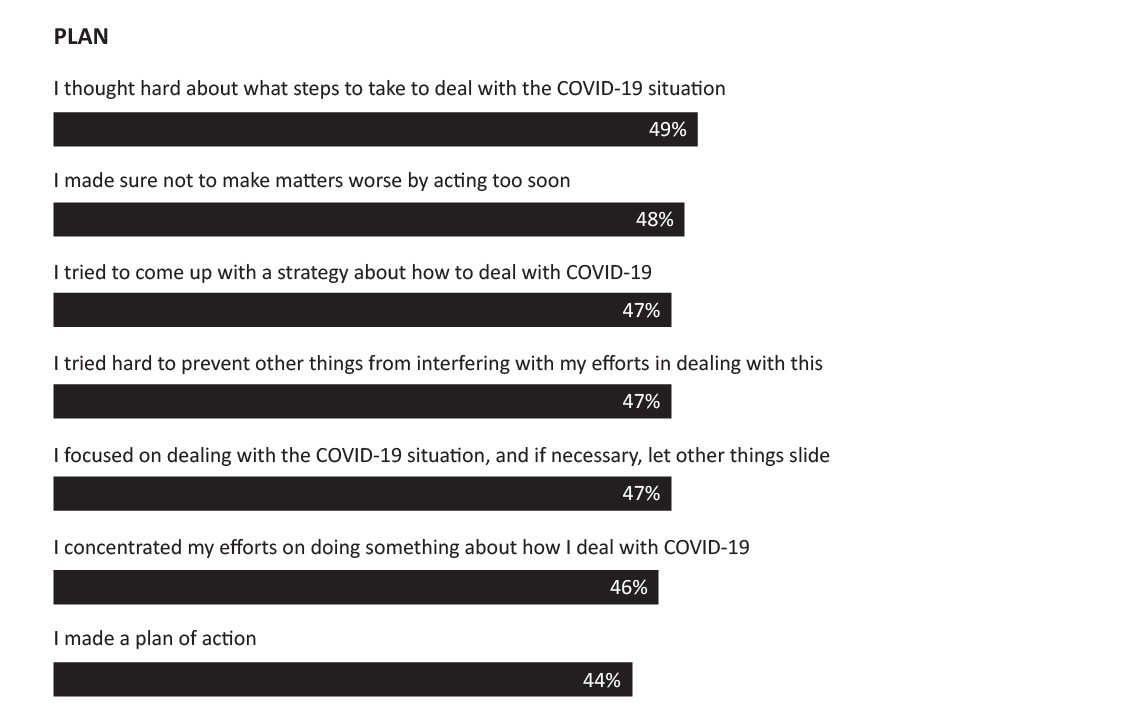

PROACTIVE PLAN OF ACTION

Nearly half of consumers are starting to make detailed, focused plans. As we’ve seen in other work, like the post pandemic process and the re-emergence of gatherings, consumers are looking to marketers for guidance.

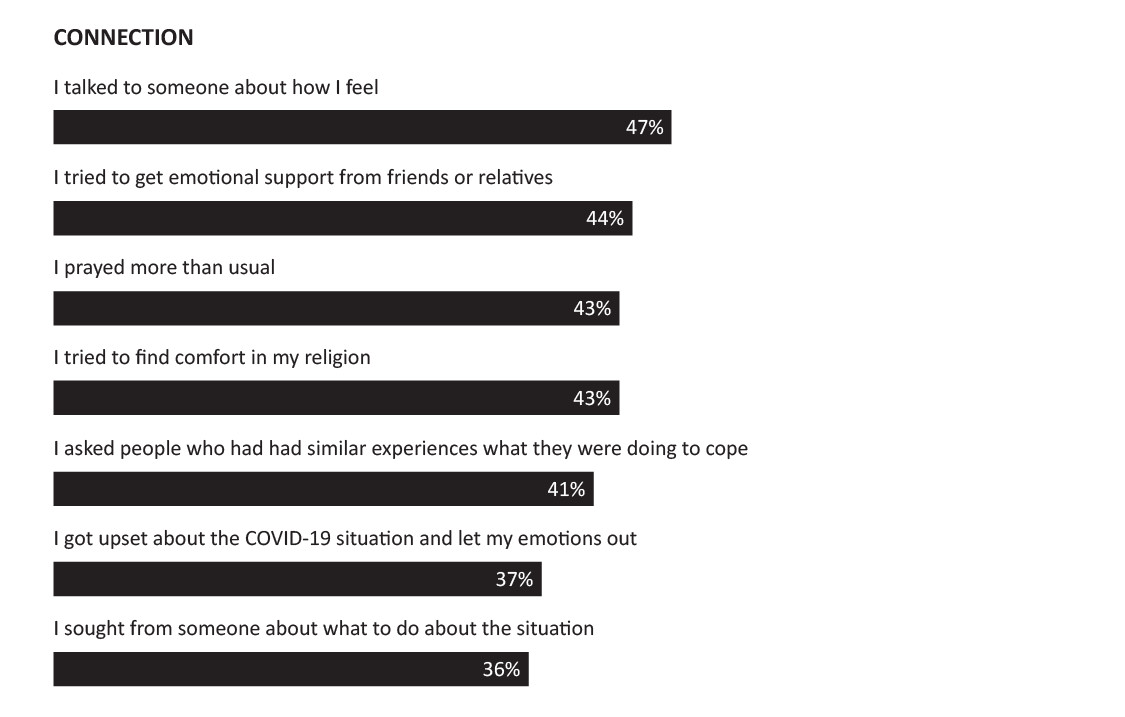

CONNECTION, RELIGION, & EMOTION

During this challenging time, there have been moments where we’ve needed emotional support in both our personal and professional lives. This is where spirituality and mental wellness may come in.

OUR INDULGENCES: SOME GOOD… SOME LESS GOOD

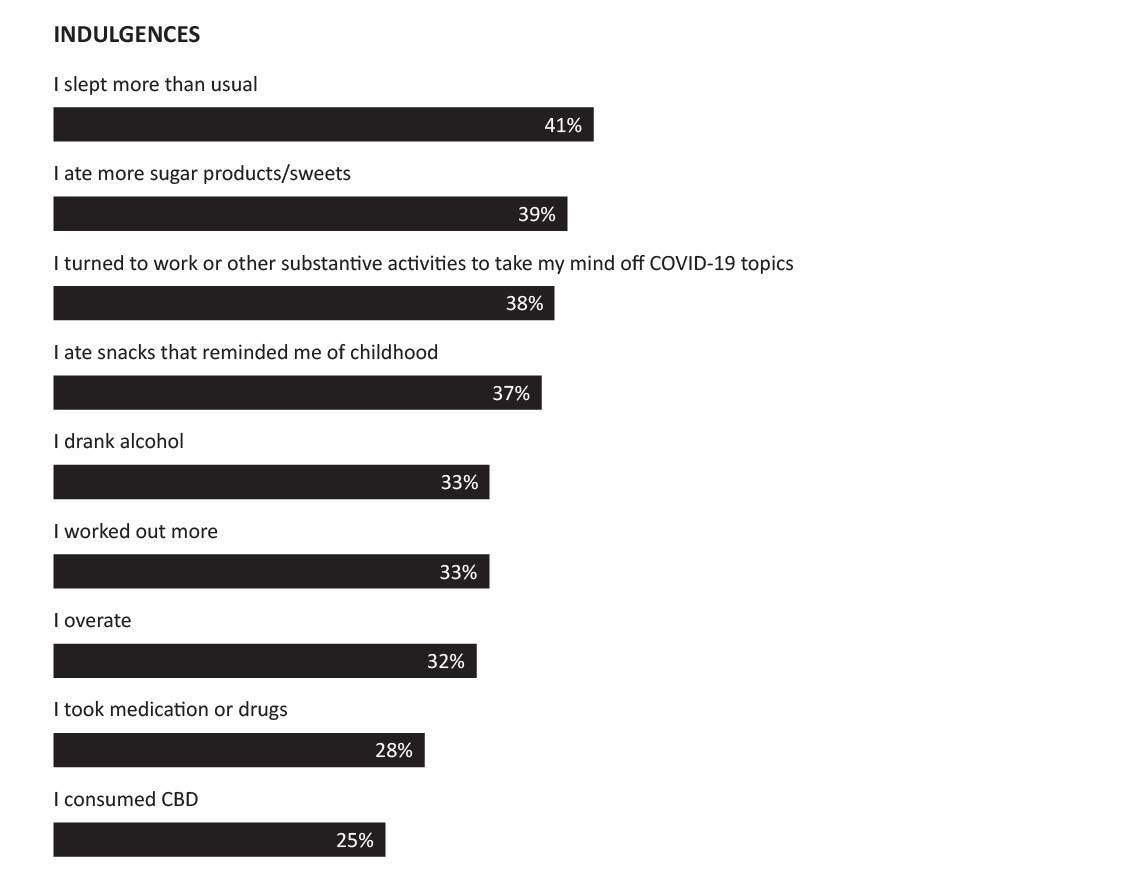

Our indulgences can play a major role in coping. For two-thirds of audiences, they may be sugary sweets that recall childhood, or healthy activities like working out. For others, it might be over-eating or drinking alcohol. According to the model, a few of these are considered behavioral disengagement activities and are actually not about coping at all, but denial.

DEFIANCE & REFUSAL

Despite the fact that much of our coping can be positive, it should be noted that one-third of consumers continue to be in denial about their loss. This reinforces the fact that for some, the world may be reopening, but their own emotional re-emergence has yet to start.

Q: COVID-19 disrupted our way of living to various degrees. We all have dealt with it in different ways. Take a look at the following statements, how much do you agree with the following statements?

A CALL OUT FOR THOSE LOST WHEN IT COMES TO MENTAL HEALTH & PERSONAL IDENTITY

Those that lost the most regarding identity and personal identity were more likely to be young (43% under the age of 34) and more likely to be women (54%). More importantly, they had significantly higher propensities to cope through their vices: greater percentages reported drinking alcohol, taking medication, consuming CBD, and overeating.

RESILIENCY MUST START WITH COAXING… NOT ACTION & RESPONSE

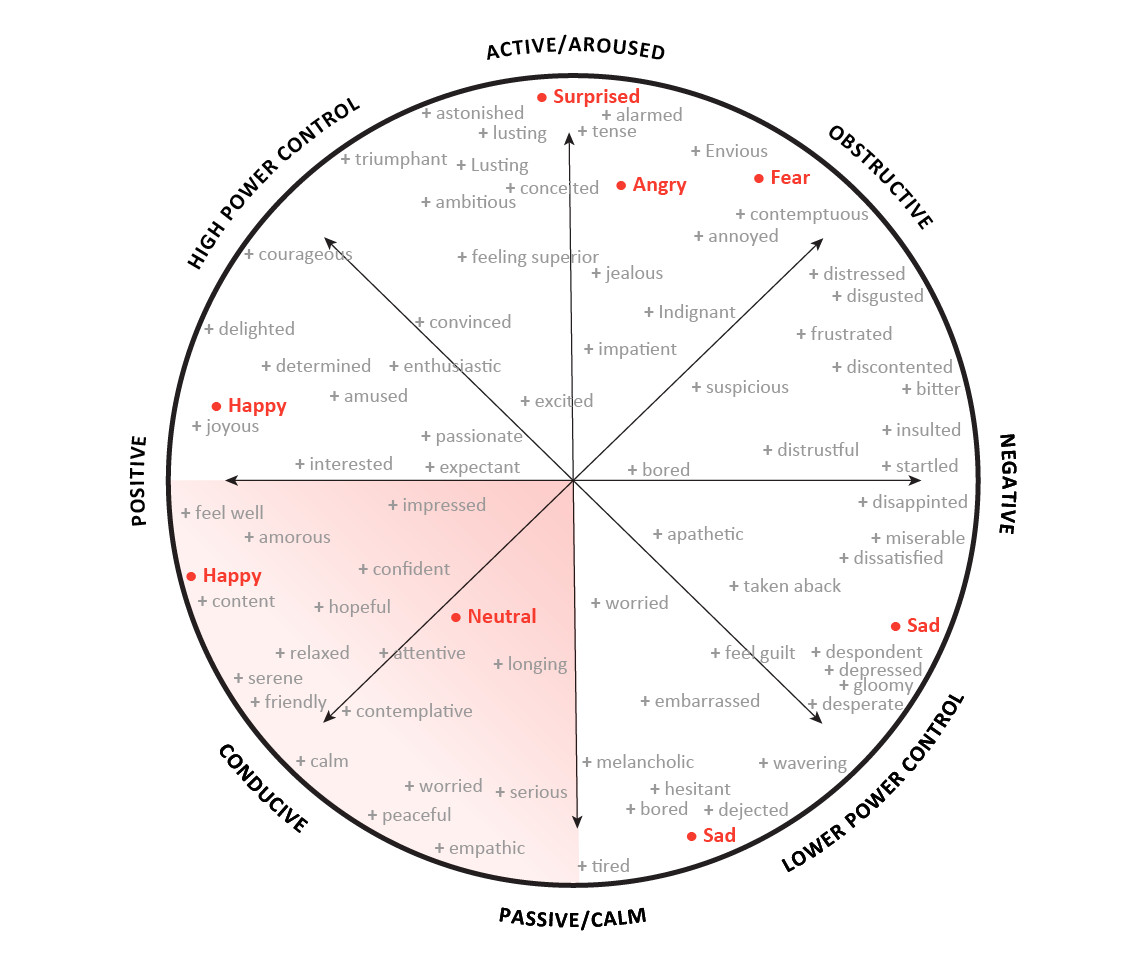

Despite their current state of mind, people will re-emerge from this pandemic with as much positivity as negativity. We used Scherer’s Circumplex Model (2005) to understand the emotion of the moment. While we know that they are tired and tense, the same 67% state that they feel some positivity and are mainly looking to find hope, calm, or peace. It’s essential to focus on these attributes as they are in the lower left quadrant of this graph below.

The graph shows that even though consumers are finding calm and peace, they’re not quite ready for active incitement and control (located in the upper left). That’s to say, brands must start to coax consumers and create a safe space as they re-emerge, resisting the urge to “push them” into action.

As they re-emerge, there is a desire from consumers to invest more in themselves, support the big changes they plan to make, and reconnect with friends and family — it’s clear that authentic connections matter more than spoiling themselves with material things. In fact, only 9% say they will spend on items like they’ve never spent before.

SOME BIG CHANGES AHEAD

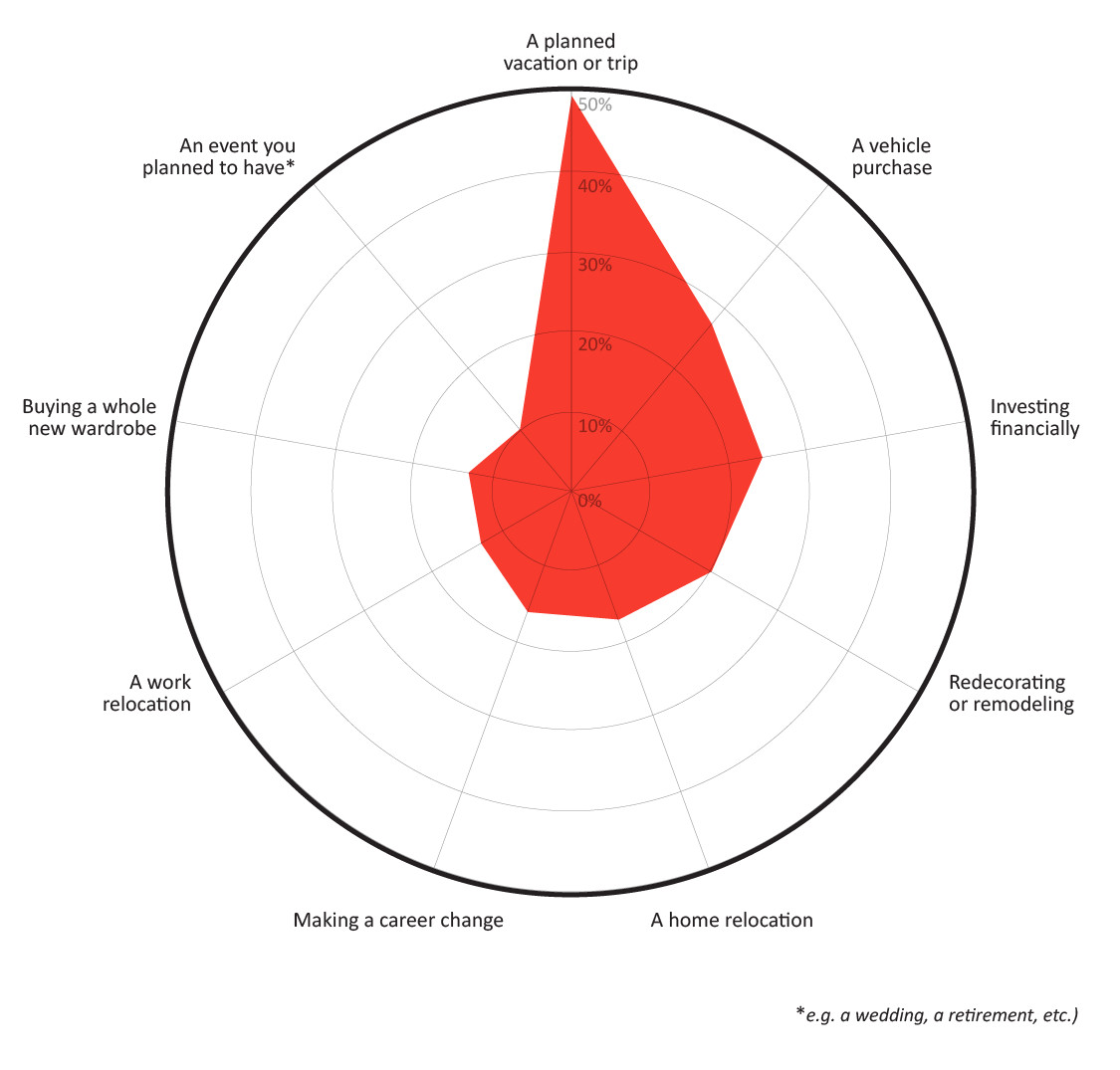

With that said, here are some of the big changes consumers believe will happen in the next 6 months…

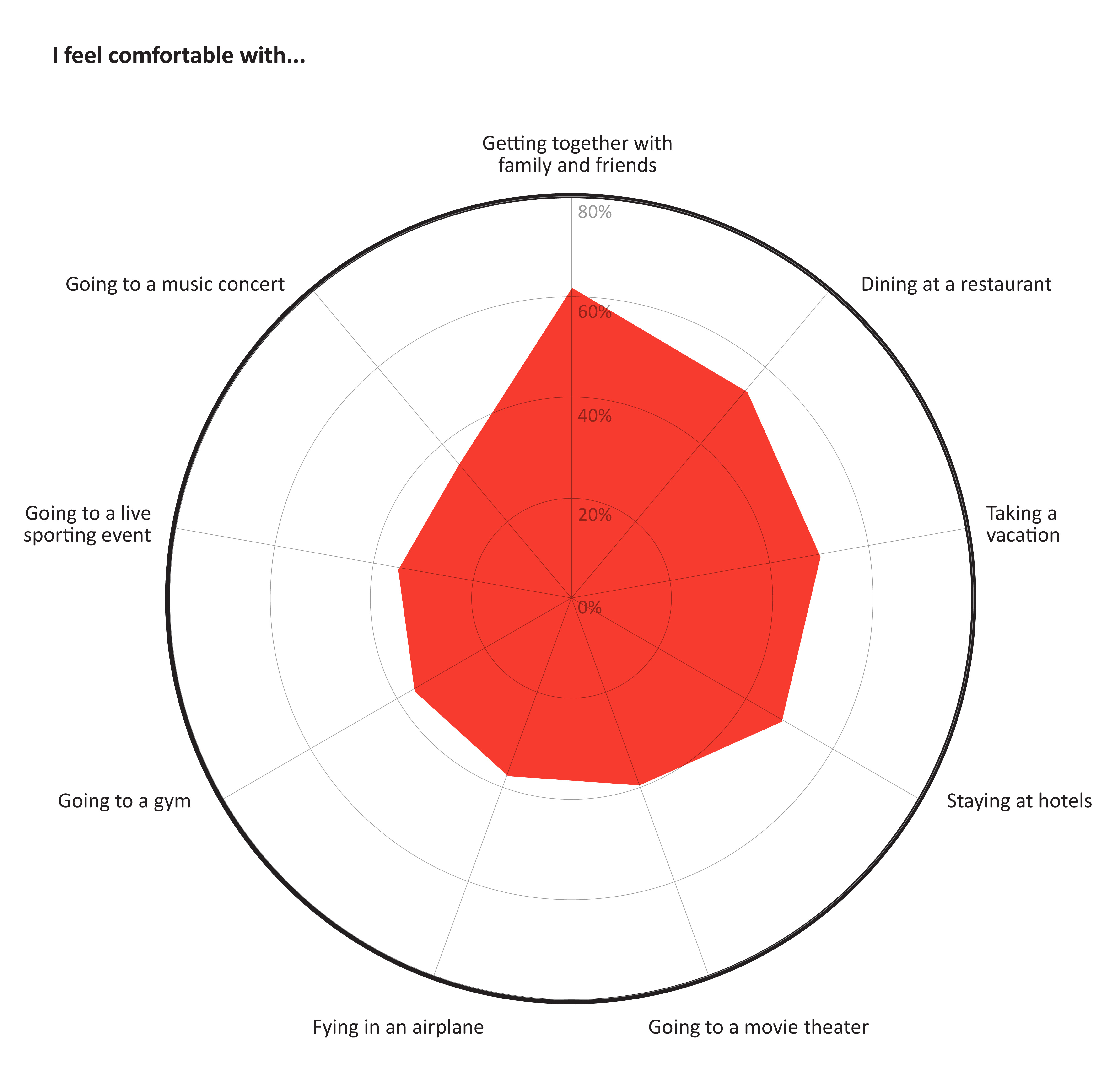

… And a healthy list of things that consumers are ready to do. It’s not surprising that the same list matches the data from our last study around the post-pandemic process.

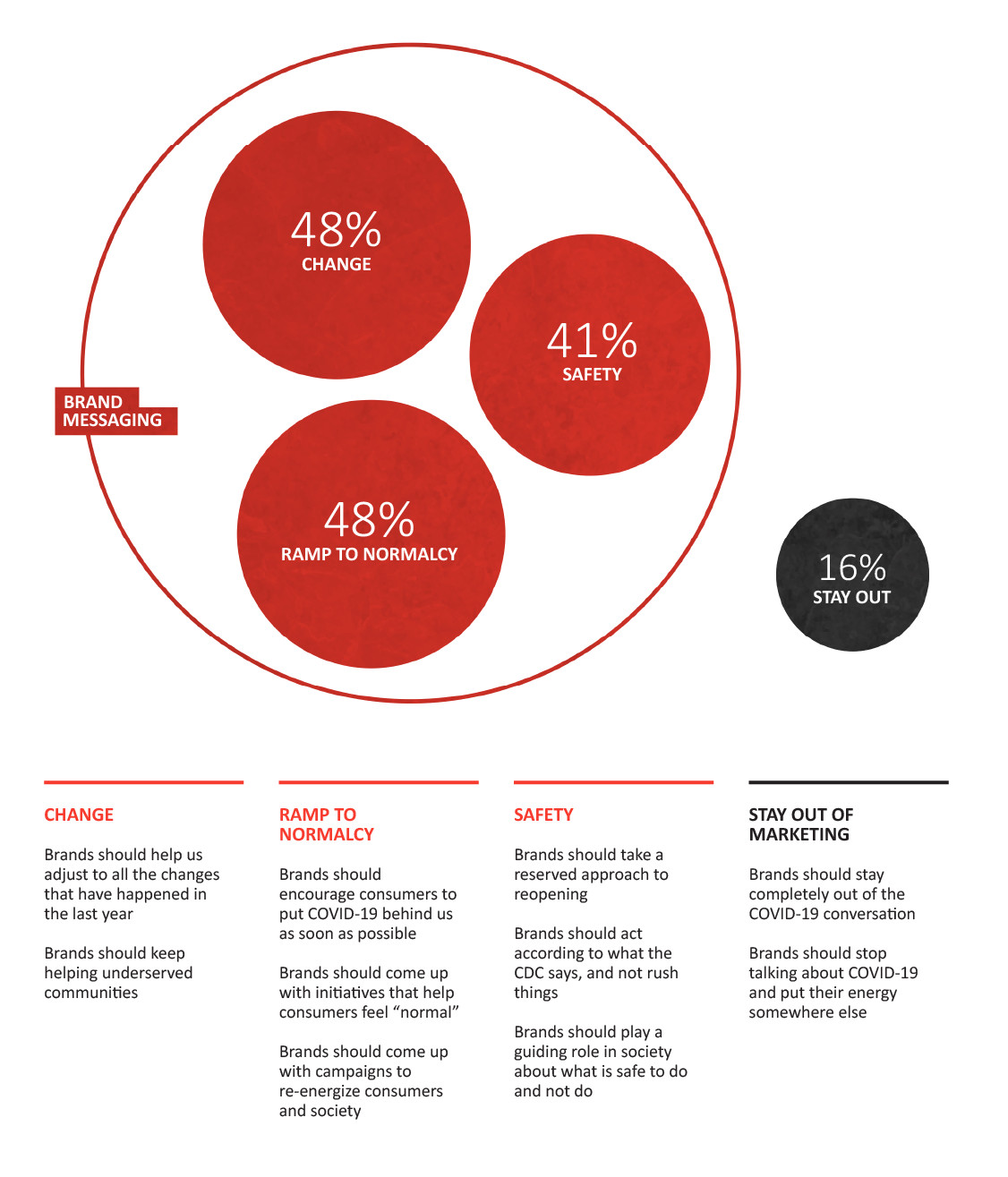

OUR EXPECTATION FROM BRANDS’ MESSAGING

The vast majority of consumers (84%) expect brands to participate in this process of reconnecting. Most importantly, they want brands to stick with meaningful change, keep talking about adjustments, and continue helping the underserved — a recurring theme that came out of the pandemic. What follows is a ramp back to normalness that re-energizes us… safely, of course.

ATCS Insights also found tens of thousands of social conversations in which consumers voiced expectations of brands during the pandemic. After a year of isolation and uncertainty, consumers are holding brands to a much higher standard before buying from them. Consumers hope that brands will not just help them reconnect with others, but also promote events that will enable a feeling of belonging. This desire for community building and genuine, in-person bonding goes hand-in-hand with the expectation of authenticity and inclusivity. Consumers want brands to have a voice and stand up for their beliefs. In a way, consumers are expecting brands to act like a friend; one that is honest with them, shares their values and is there for them when they need them.

IN CLOSING, IT’S NOT ABOUT PUSHING THE CONSUMER BUT HOLDING THEIR HAND

We’ve spent a lifetime talking about aspiration and inspiration in branding, but as we look toward the future, what we all might need is a little more empathy.

Edwin Wong, Naira Musallam, & Sasha McTernan contributed to this report.

Methodology A survey was commissioned to ~2,500 consumers in March 2021. Our partner, SightX is a premium research partner. Their goal is to automate curiosity.

ATCS Insights focuses on understanding today’s rapidly changing consumer behaviors and overall societal trends. Our robust data collection is sourced by social platforms and thoroughly analyzed by a team of passionate experts that help clients explore consumer needs, passion and pain points, usage and motives, all as quickly as they occur. For more information, go to insights.atcs.com.