It’s no secret that moving is one of the most stressful life events— and yet, we’re always doing it. Not even a global pandemic can stop people from changing addresses, as the last ~2-years have proved.

Ever since March 2020, when our “new normal” began, it’s seemed like more Americans have been on the move than ever before. It’s an event some have called “The Great Migration.” However, it is important to differentiate the current phenomenon of relocation from the original Great Migration, which refers to the movement of nearly six million Black Americans out of the rural Southern United States to the urban Northeast, Midwest, and West between 1916 and 1970.

Just how “Great” has this current phase of pandemic-era relocation been? To find out, we partnered with the research company Corus on a survey of over 2,000 Americans who have recently moved.

Our aim was to:

- Understand COVID’s impact on moving

- Identify who moved and why

- Determine whether the move was positive or negative

- Find out how moving may have impacted patterns of spend

What we found was somewhat surprising. By 2021, the majority of those who were willing and able to move due to Covid had already done so; as a result, nearly six million fewer Americans moved this year because of the pandemic. Read on for more discoveries and how marketers can help fill the gaps in times of transition.

JUST HOW GREAT HAS THE “GREAT RELOCATION” BEEN?

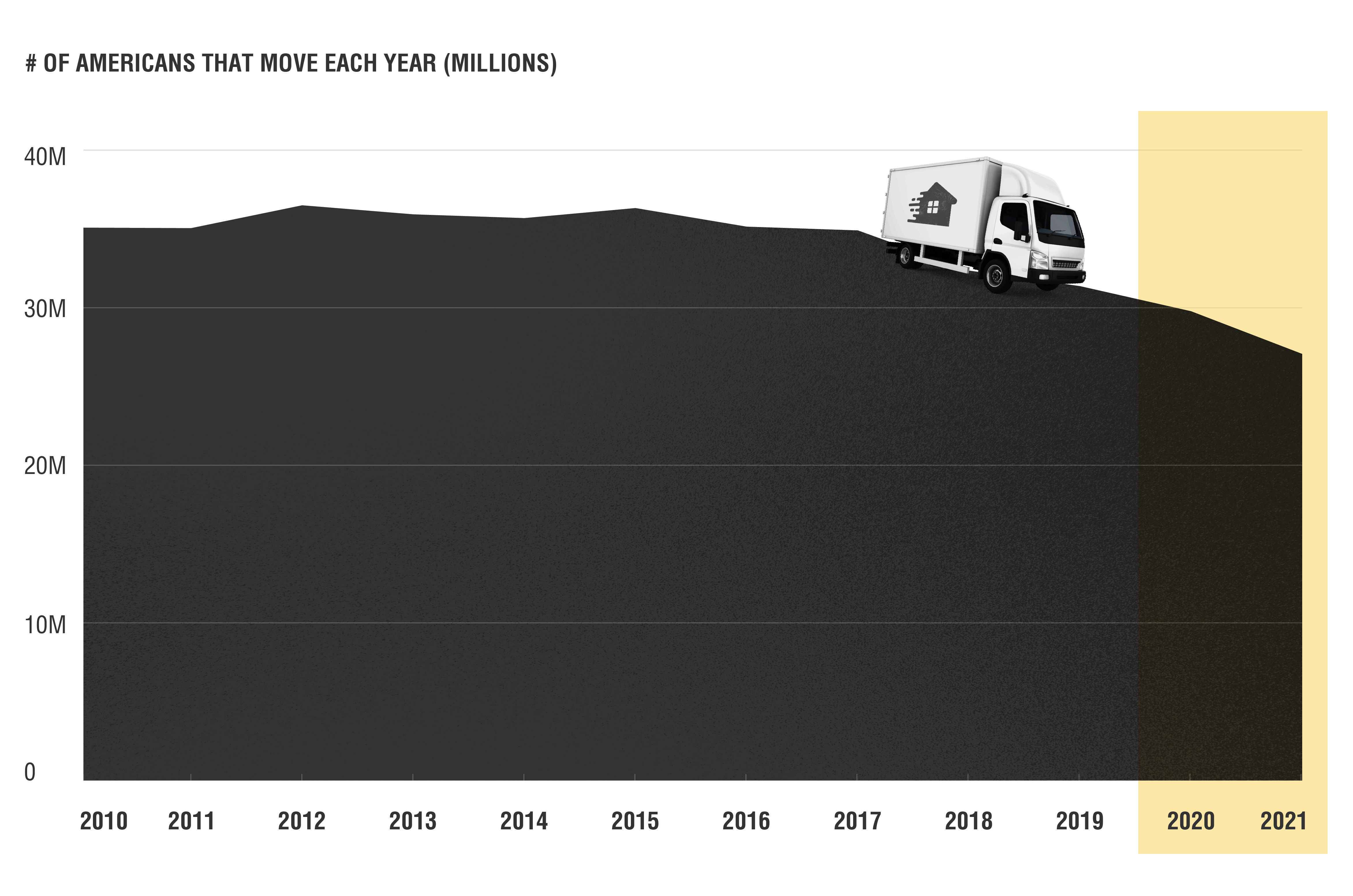

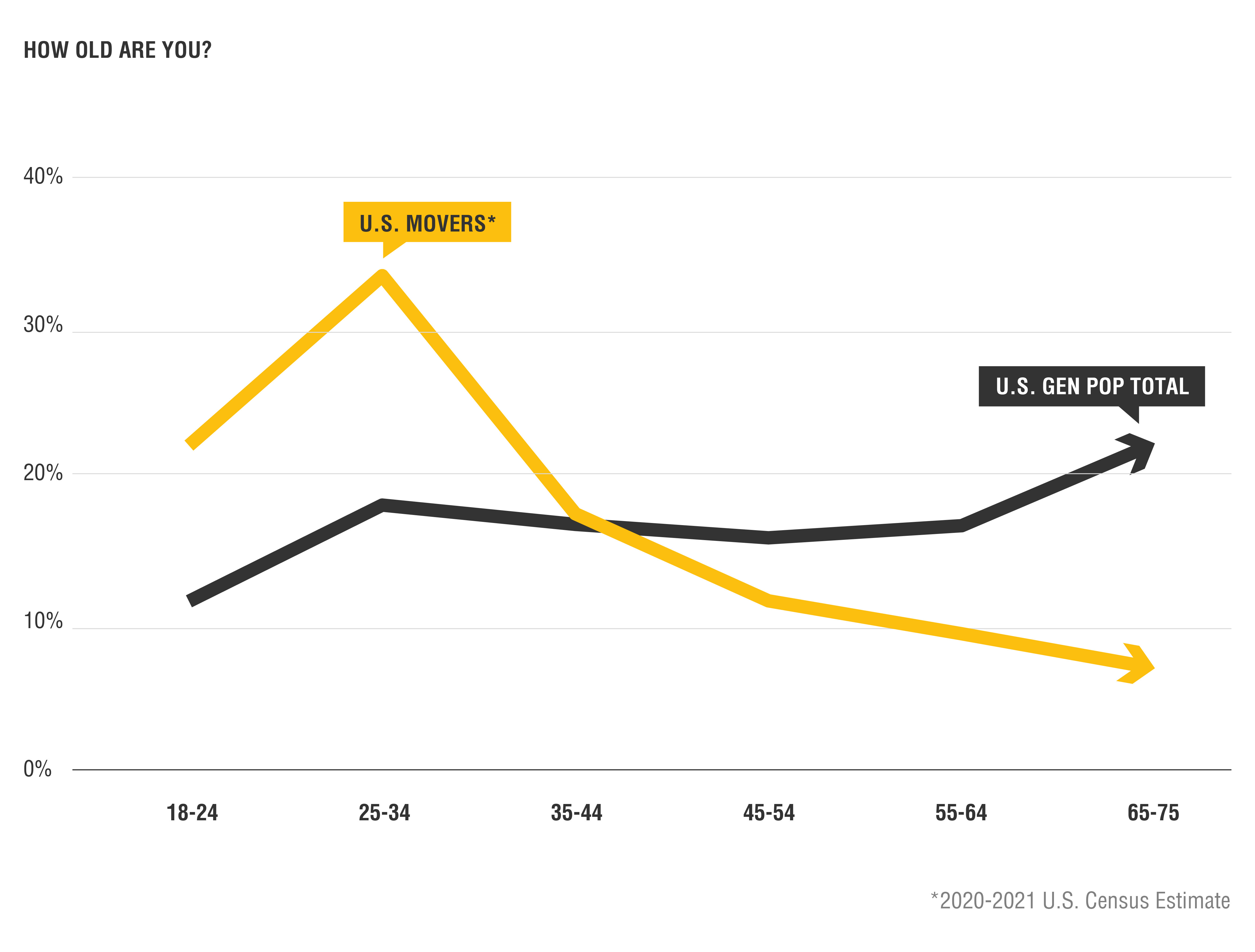

From February 2020 to December 2021, about 56 million Americans, or about 17% of the population, moved to a new home. That sounds like a lot, but when placed in historical context, it’s a number that has been steadily trending downward for more than 50 years.

Even taking into account these low expectations, the number of people who moved in 2021 was still 9% smaller than in 2020. You would have to go back to 2007, the year of another global crisis (that would ultimately lead to the Great Recession in the U.S.), to find an annual drop that significant. Perhaps Covid has actually acted as a deterrent to moving— the opposite of what we’ve been thinking.

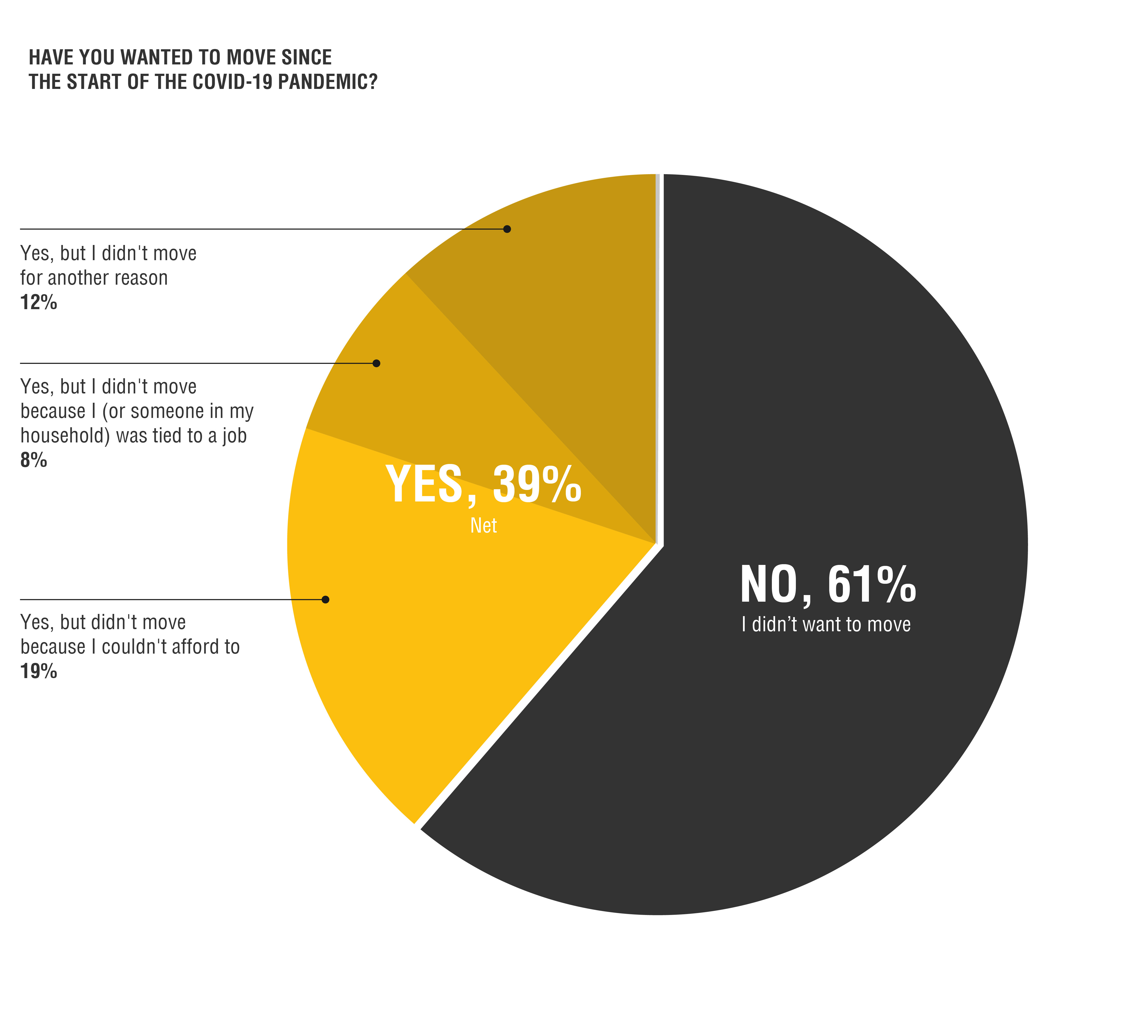

To find out how much unrealized demand there is for moving, we asked 6,478 Americans who didn’t move during the pandemic whether they wanted to. The results were striking: nearly four in ten said that they would have moved, but for other challenges.

Clearly, “The Great Relocation” isn’t so much about numbers as it is about Americans moving under extraordinary circumstances and with more unknown factors than before.

Why did moving drop so sharply in 2021, and not in 2020 when the pandemic began?

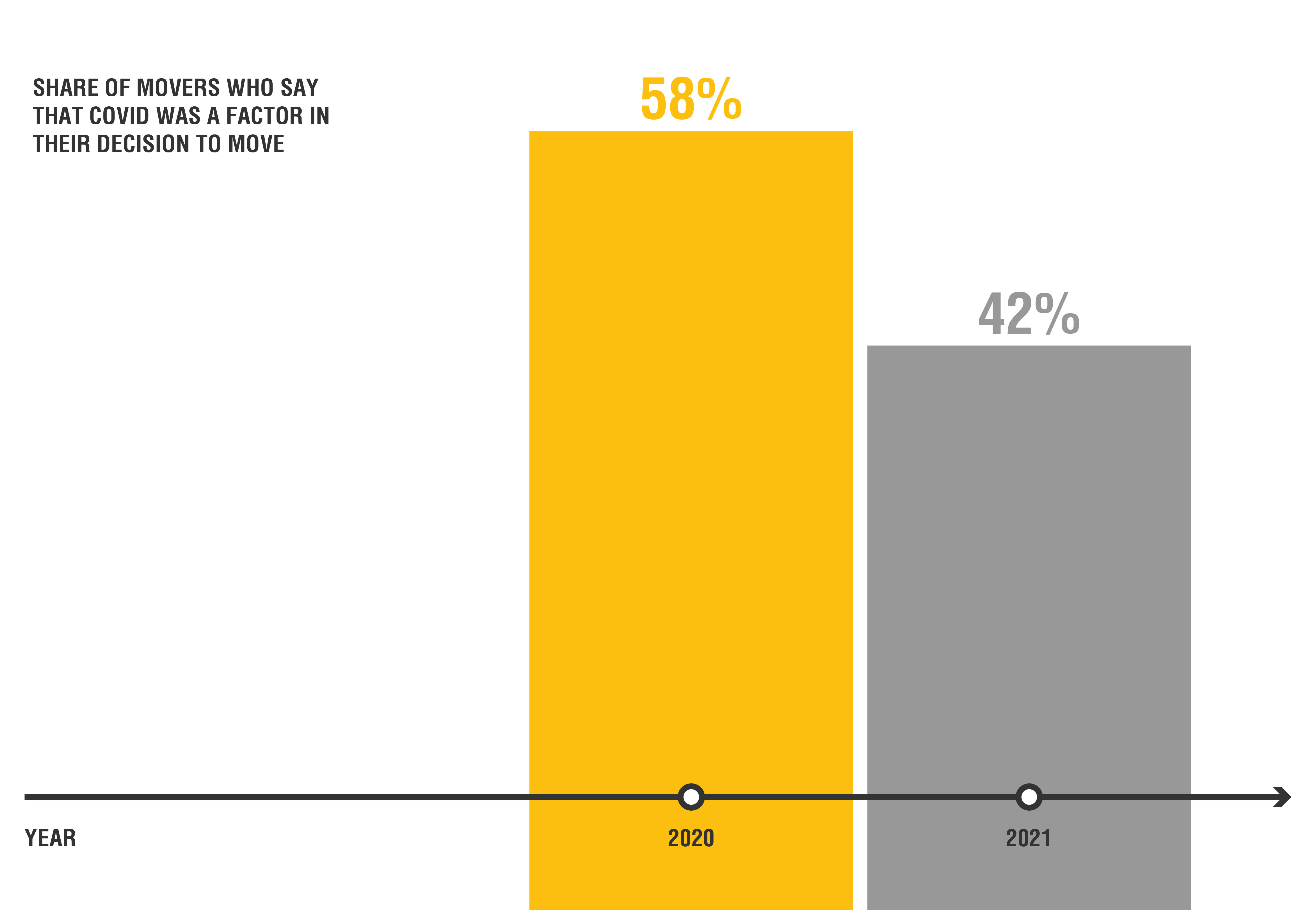

In 2020, almost six in ten Americans who moved said that Covid factored into their decision. Many of these moves were temporary, especially among college students whose campuses were shut down, and young workers who were laid off or furloughed.

This fueled a surge of migration that partly offset the number of people who would have moved otherwise, but decided against it because of the pandemic.

However, by 2021 a majority of those who were able and willing to move because of Covid had already done so, and as a result, nearly six million fewer Americans moved in 2021 because of the pandemic.

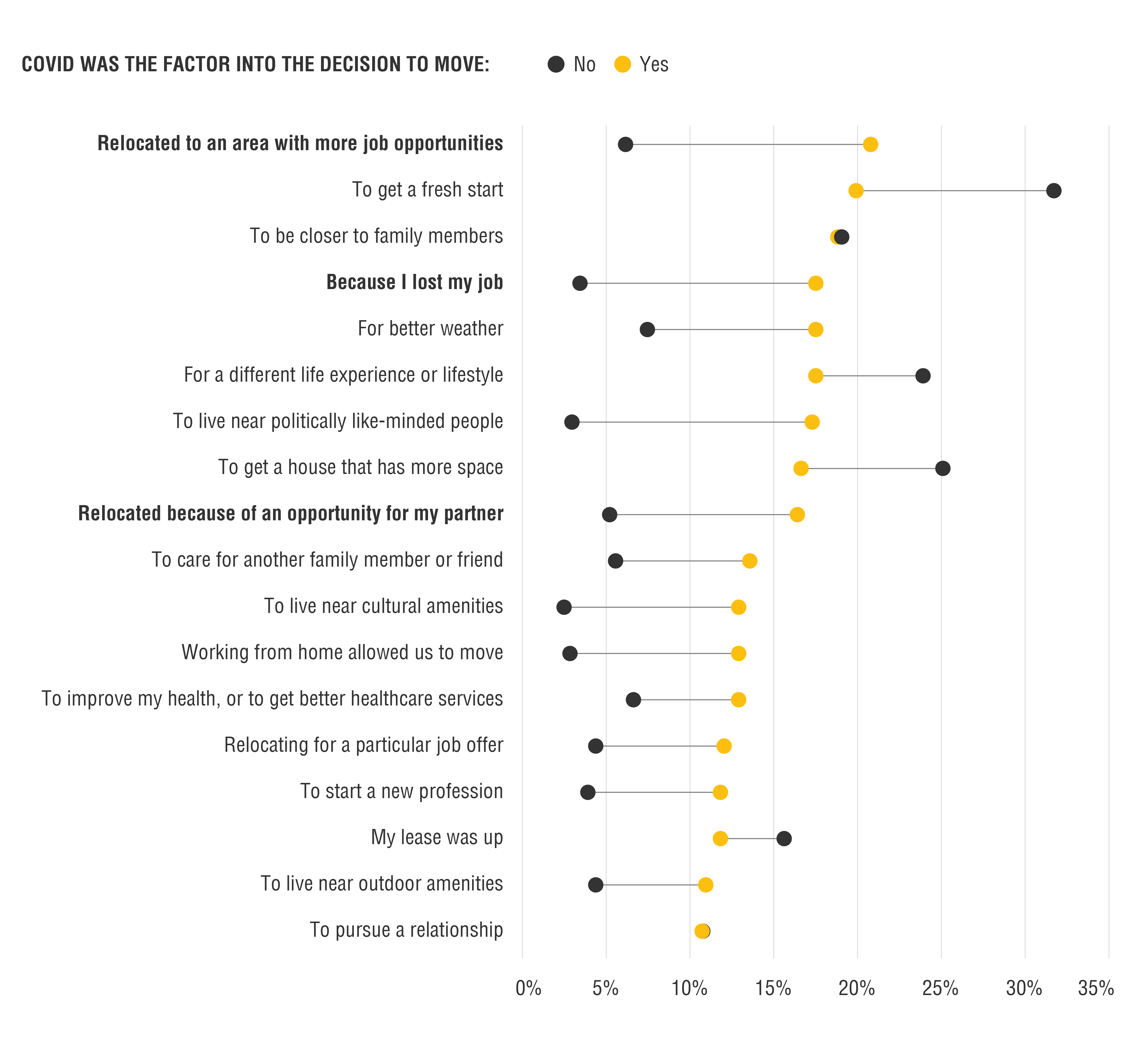

In fact, when we break out the top reasons for moving during the last two years by whether Covid was “decisive” in the determination to move or “not a factor,” we see big differences. Above all, those who moved because of Covid are likeliest to say it was because they were seeking work (21%). Not far behind are two closely related reasons: because they lost their job (18%) and because their partner was offered a new opportunity elsewhere (16%). All three of these reasons were cited at much lower rates by those who say that Covid was not a factor in their decision to move.

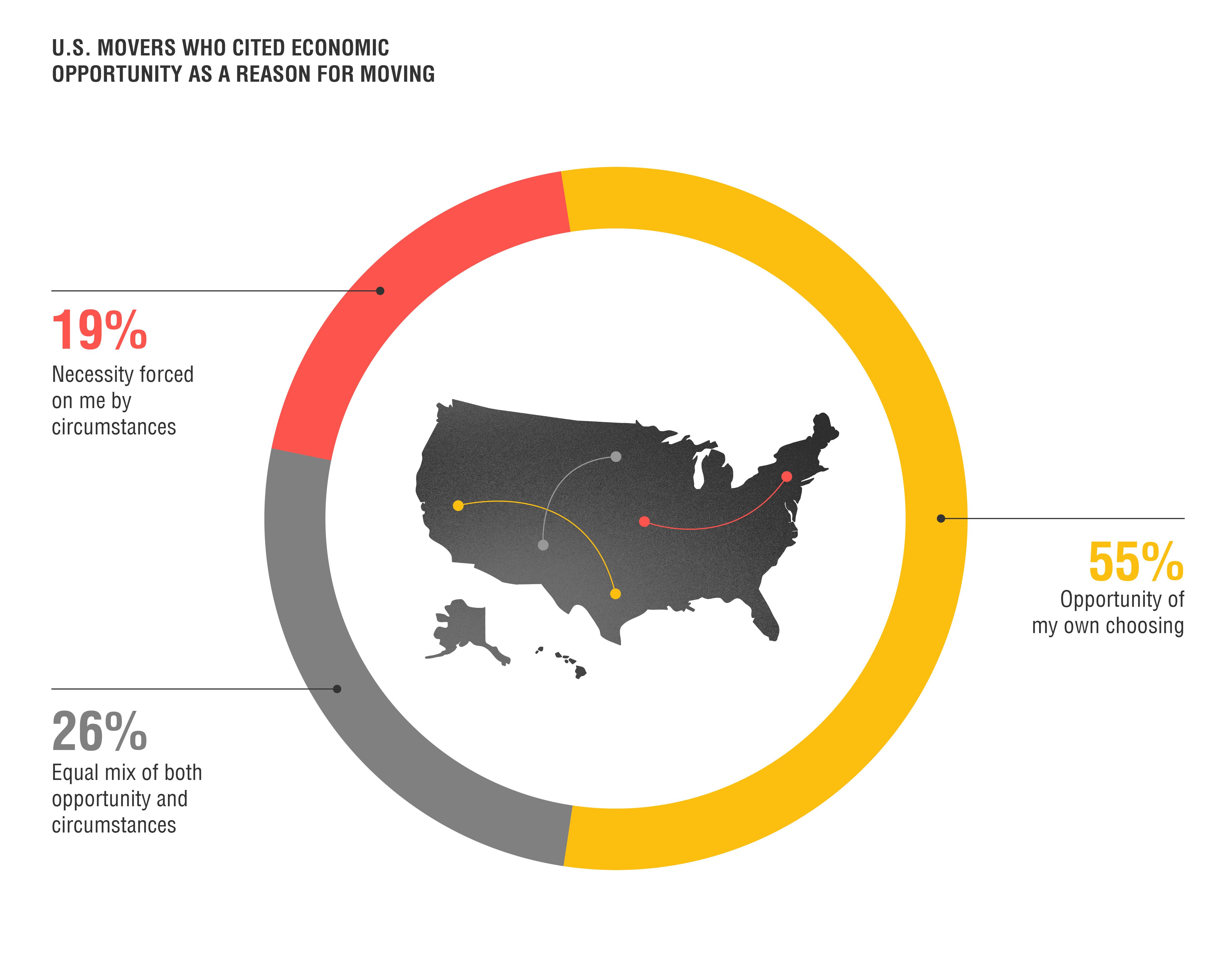

However, it would be wrong to suggest that most Americans who moved during the pandemic for economic reasons did so because they had no other choice. More than half of this cohort say they decided to move of their own volition.

Either way, it was most often people of working age— those with kids and with jobs— for whom Covid presented the kinds of problems that relocating might solve. For many such Americans, the pandemic also provided an opportunity to move and pursue other goals unrelated to Covid.

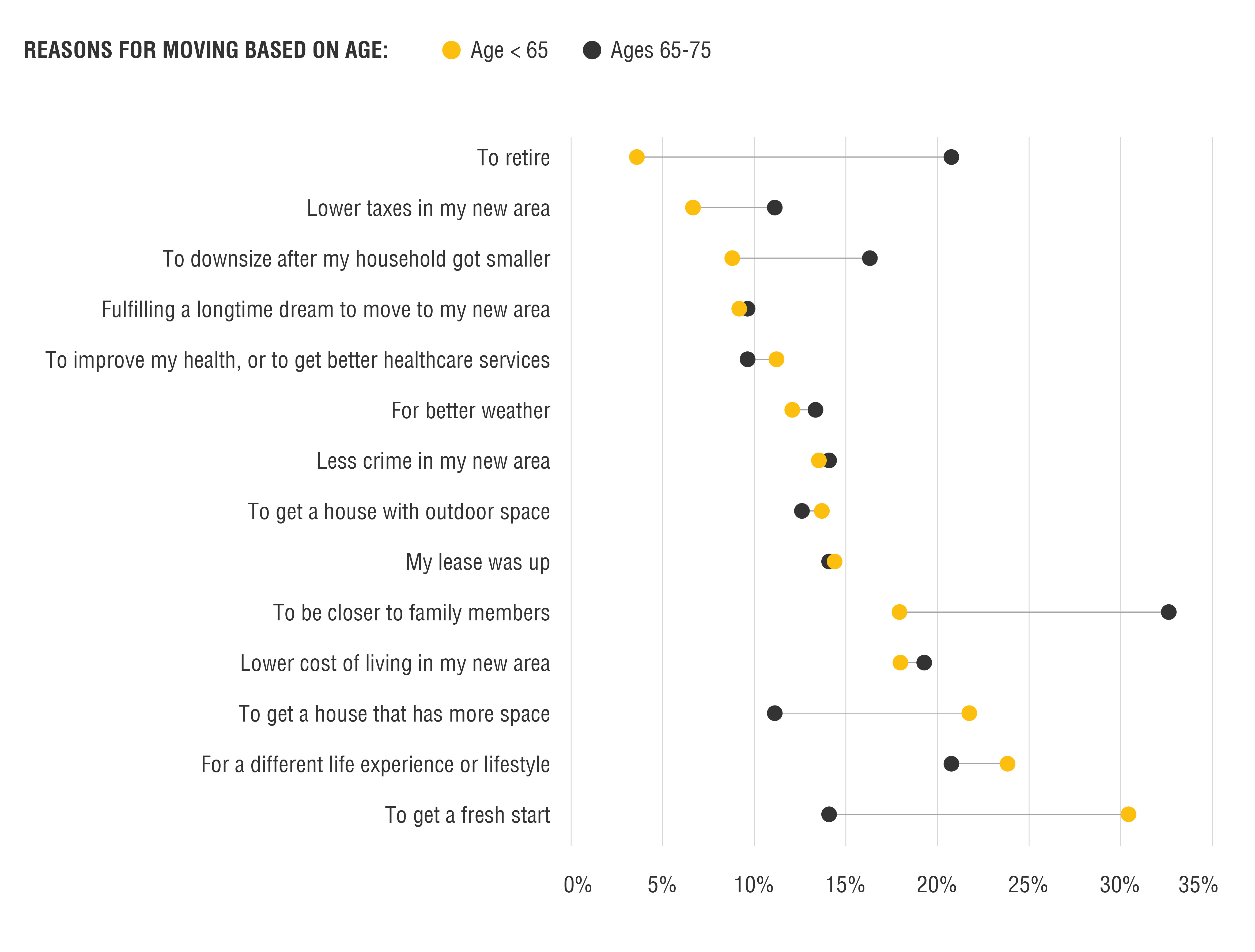

But it’s different for older Americans. When they move, it’s often due to specific life changes, like retirement.

All things equal, they are therefore far less likely to move than younger people. Starting at around 45 and advancing with age, the share of elderly Americans who move each year falls further and further below their share of the population.

Although they were (and still are) at much greater risk from Covid, for most older Americans, it was unclear that moving would decrease rather than increase their risk of infection. For these reasons, the elderly were much less likely to say that Covid was a factor in their decision to move.

THE GREAT FRESH START

Although relocating for work was a major storyline of the pandemic, when we add up the total number of moves due to economic factors, it turns out to be a very small share of the total migratory picture.

Women had a greater tendency than men, by a difference of 17 percent, to say that the move was the product of necessity instead of choice.

THE GREAT REGRET

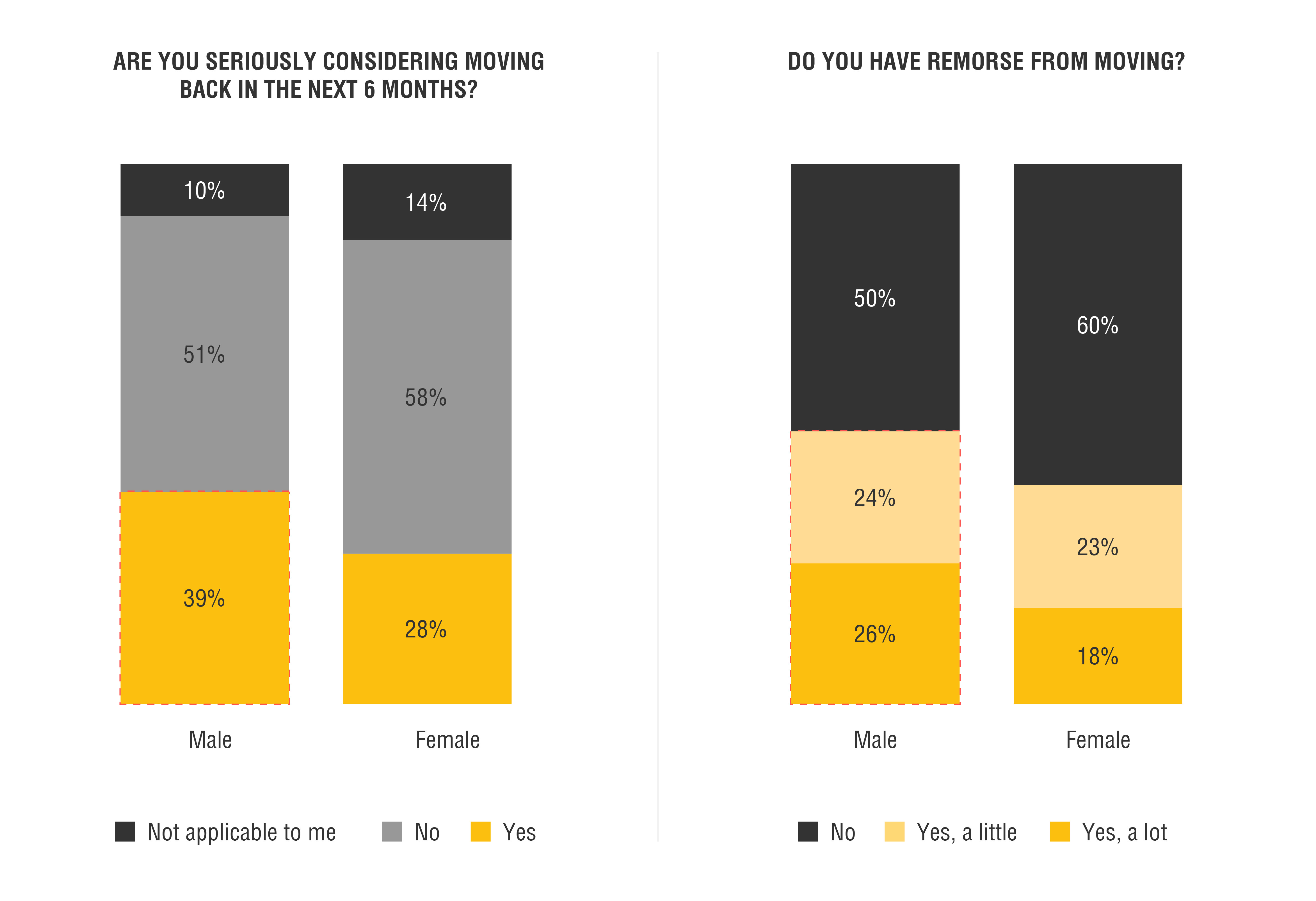

It’s clear that women tend to be better at adapting to a new move. Whereas five out of every ten men said they felt either “a little” or “a lot” of regret over moving, just four in ten women said the same. By the same token, nearly four in ten men said they are “seriously considering moving back in the next six months,” compared with fewer than three in ten women.

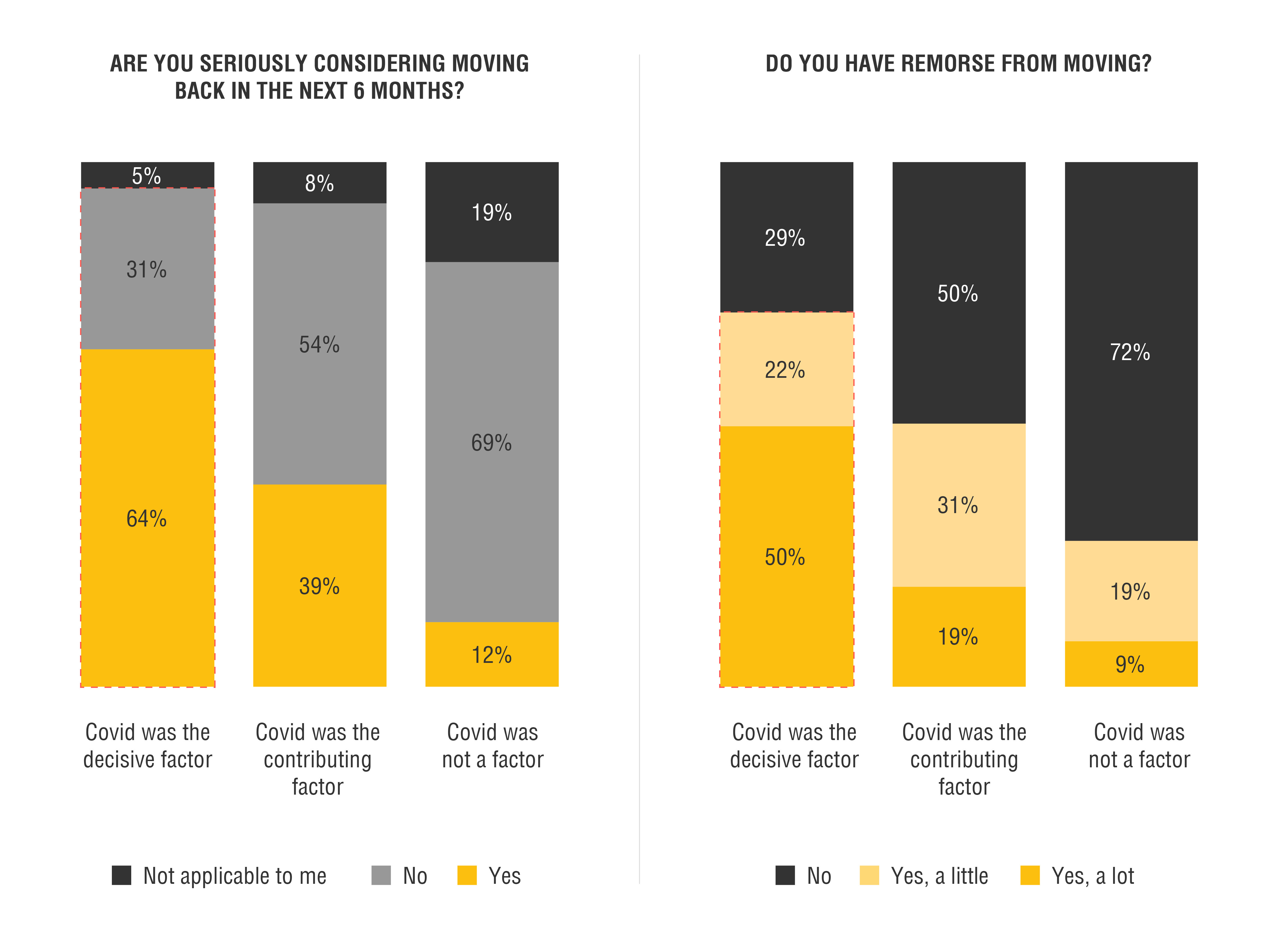

The single most predictive variable for movers’ remorse was not demographic, but the extent to which Covid was an important factor in someone’s decision to move. For those that said Covid was decisive, more than seven in ten said they felt regret over moving, and more than six in ten said they seriously considered moving back.

The most obvious explanation is that many of these moves had intended to be temporary, perhaps resulting in a new set of problems and frustrations.

THE GREAT EMOTIONAL REPRIEVE

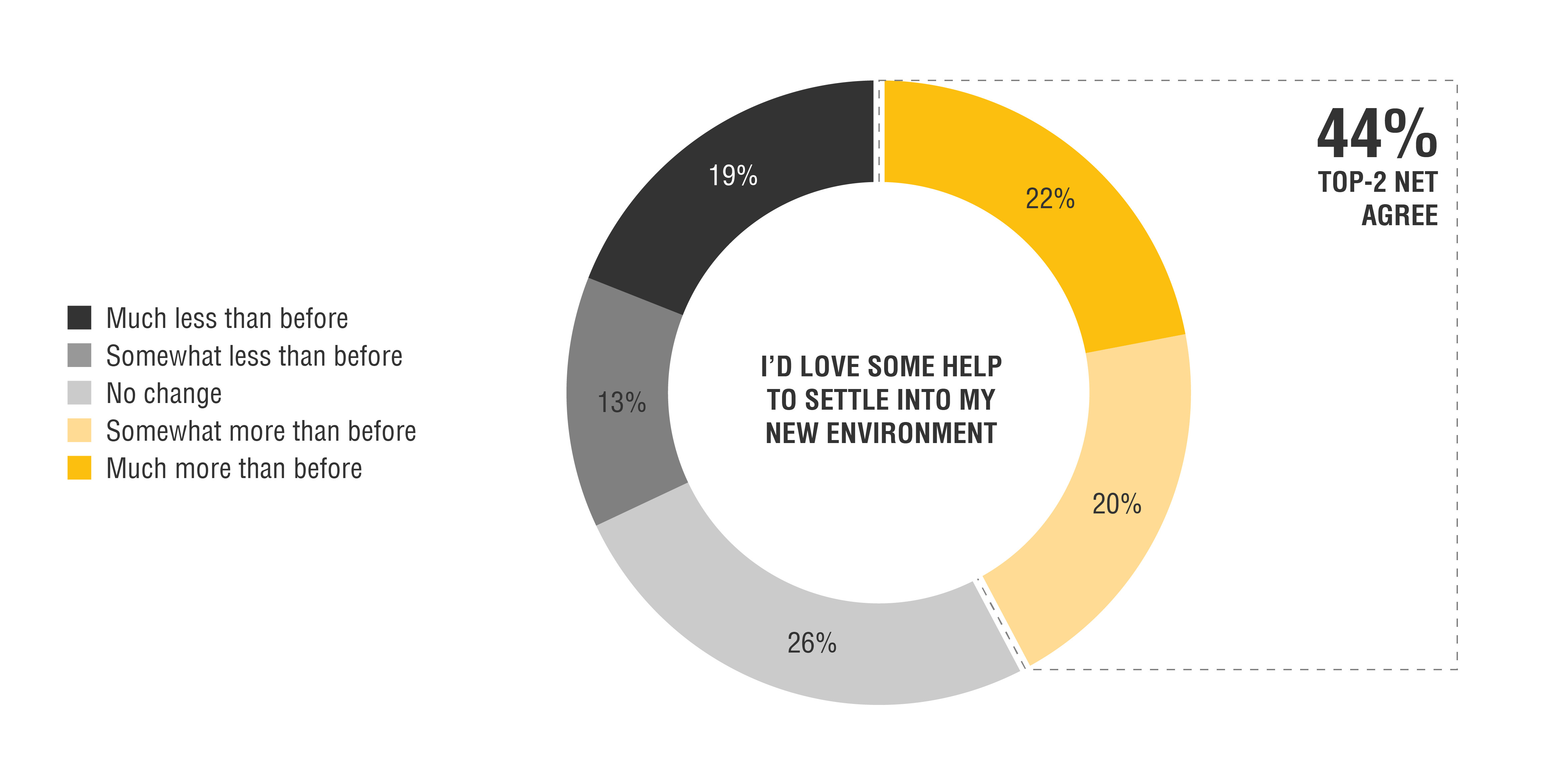

Approximately ⅗ of movers state that they are much happier, have greater life satisfaction, and feel more balanced since their move. ⅔ also report higher levels of happiness, purpose, safety and productivity. However, there still remains much uncertainty, as ~½ still feel unsettled and need help adjusting to their new environments.

Here presents the definite marketing opportunity. Nearly 2/5 of movers say they feel anxious, frustrated, bored, and unsettled due to the change. There is a clear opportunity for marketers to step in and help movers feel settled with new products and content.

UNDERSTANDING MOVING CHARACTERISTICS

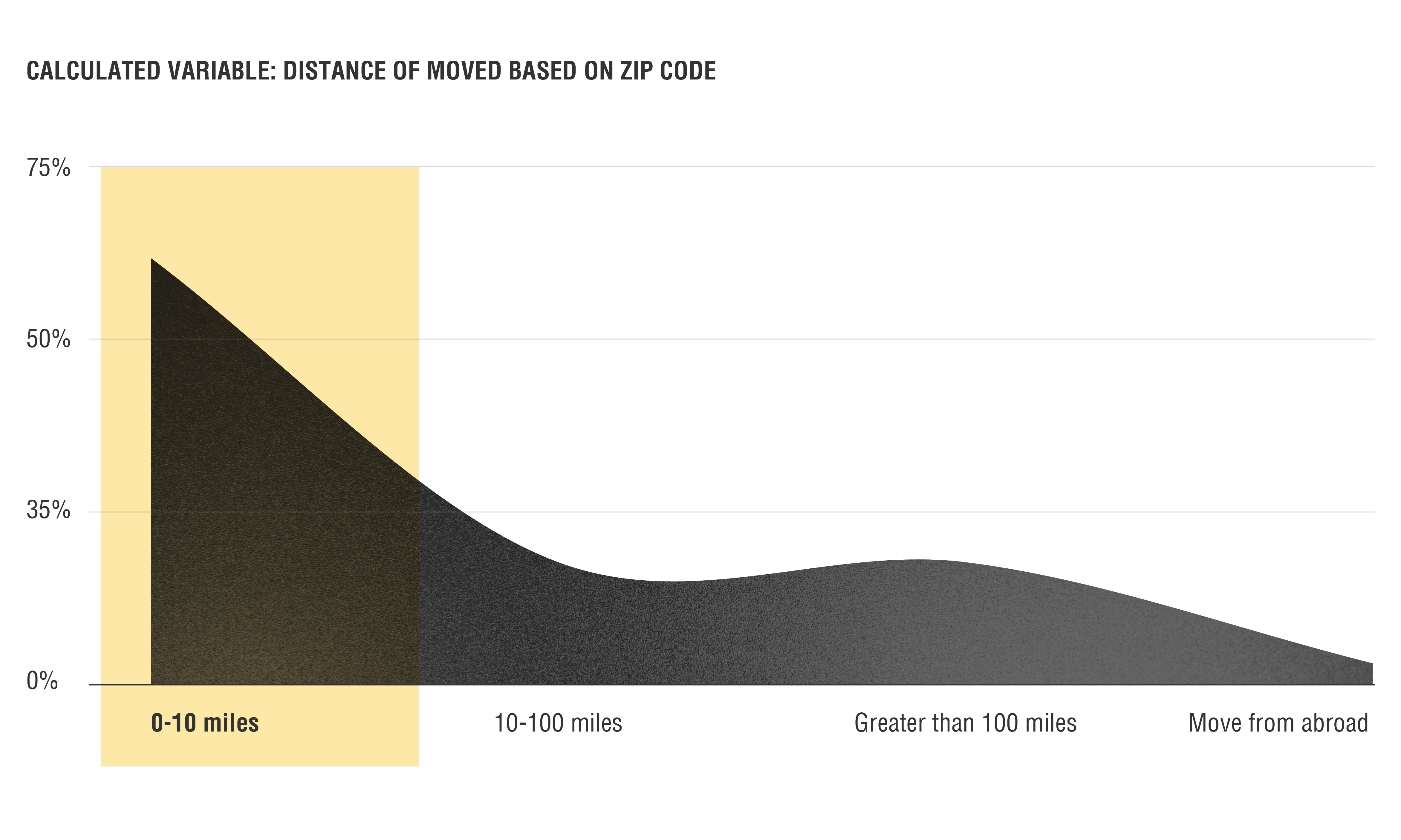

Most of the “Great Relocation” did not actually entail great distances. Using the pre- and post-move ZIP codes of study participants, we found that over six in ten movers stayed within a ten-mile radius of their original home.

Furthermore, regardless of the distance traveled, an even greater proportion of movers— more than eight out of ten— simply traded between two cities, two suburbs, or two rural areas.

Ironically, this counters what most movers say they’re looking for. 43% cite at least one of the following reasons as motivating factors in their change.

Urban-to-urban movers are most likely to say that COVID was a decisive factor in their move. Interestingly, those that moved from urban to suburban or rural areas show the highest levels of unhappiness (3-4x more).

BUYING VS. RENTING

⅖ of people who moved bought their new home, while the remainder are renting. But for renters and buyers alike, there is more demand for single-family homes than the market can currently satisfy. Fannie Mae estimates this national shortfall to be around four million units. Since around 70% of all single-family homes are owned rather than rented, the turnover of these properties is comparatively slower. Thus, even though 67% of the nation’s total housing stock is single-family homes, only 45% of those who moved during the pandemic ended up in one, whether rented or owned.

THE GREAT SHOPPING EVENT

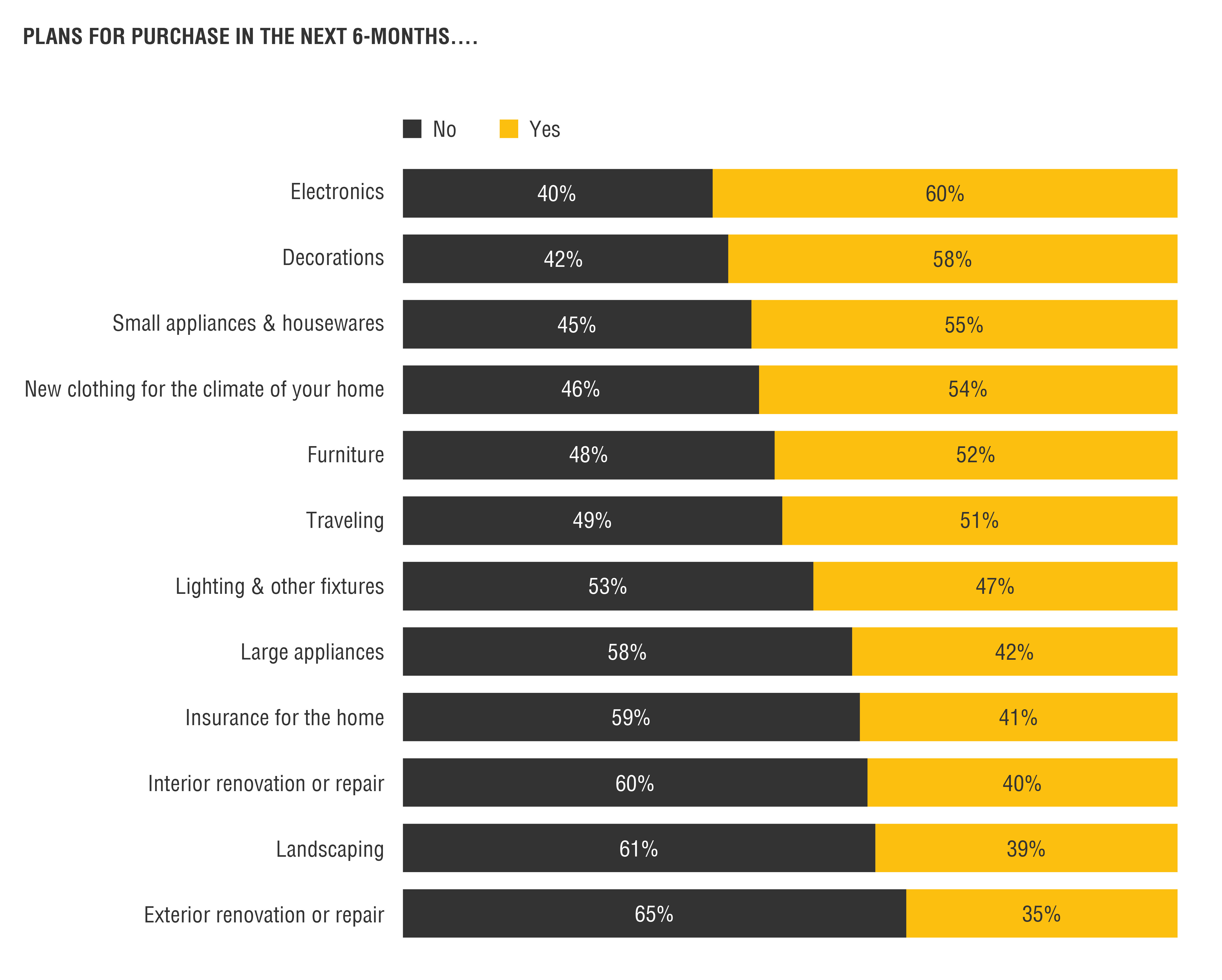

Marketers are not wrong to love movers. As a result of their recent moves, ~1/2 have spent north of $500 on furniture, electronics, and large appliances. Movers are more apt to spend on things that enhance the space as opposed to renovating the space itself.

There also appears to be as much interest in landscape and exterior renovations than interior.

Much of this shopping activity is taking place online (nearly 50%). However, the fact that some transactions still take place at brick-and-mortar shops shows the importance of store fronts and physical location when it comes to home improvement.

There is a greater interest in spending money on lower commodity purchases like electronics, decorations, small appliances, and even new clothing to wear in your new environment.

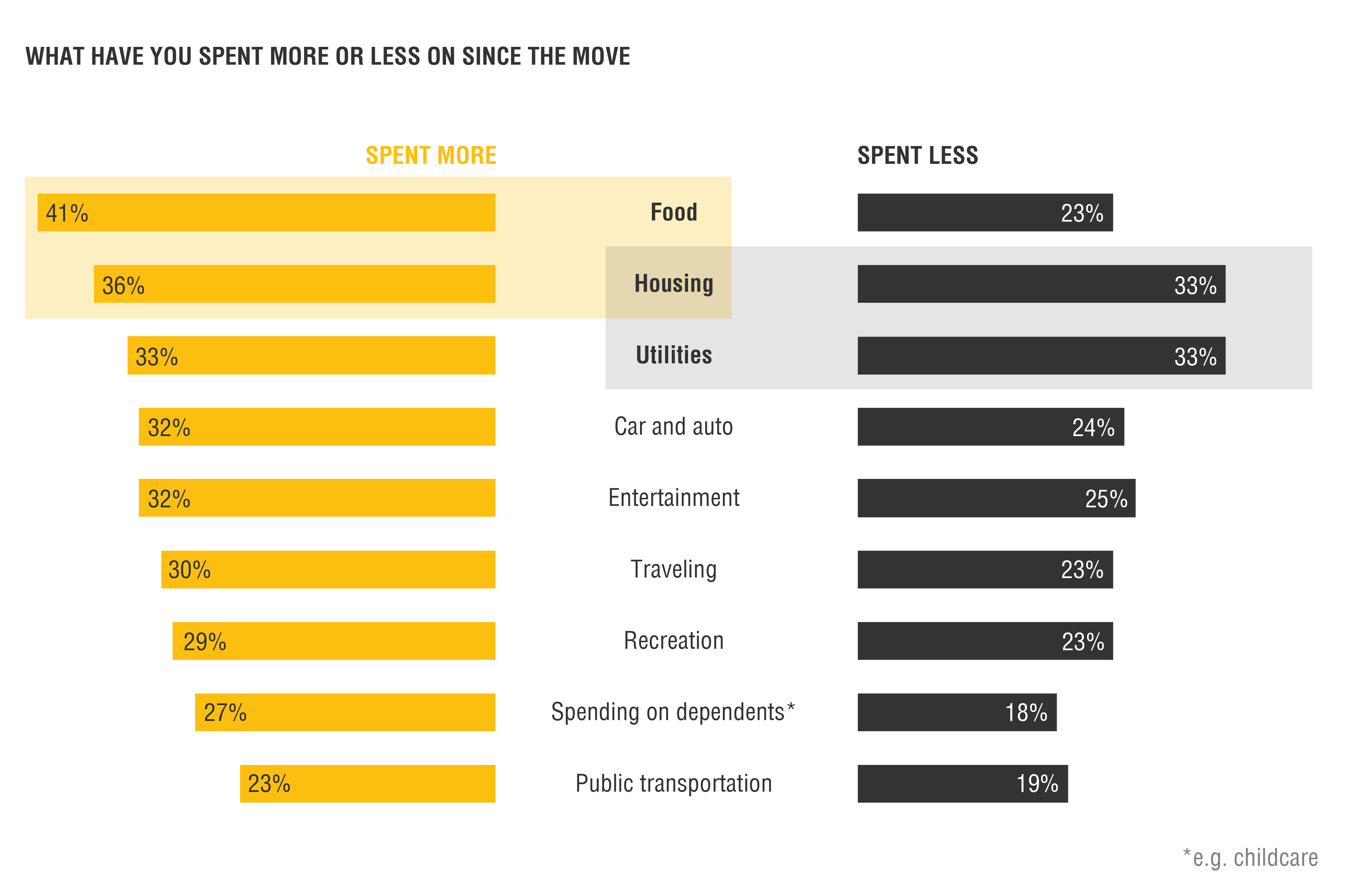

SPENDING ON DIFFERENT THINGS… ESPECIALLY FOOD

New movers have different spending priorities than in their previous lives and locations. There is a significant amount of money being spent on food, housing and utility costs. In fact, the majority are either spending the same OR more on the categories listed below.

THE GREAT VOX MEDIA CONSUMER

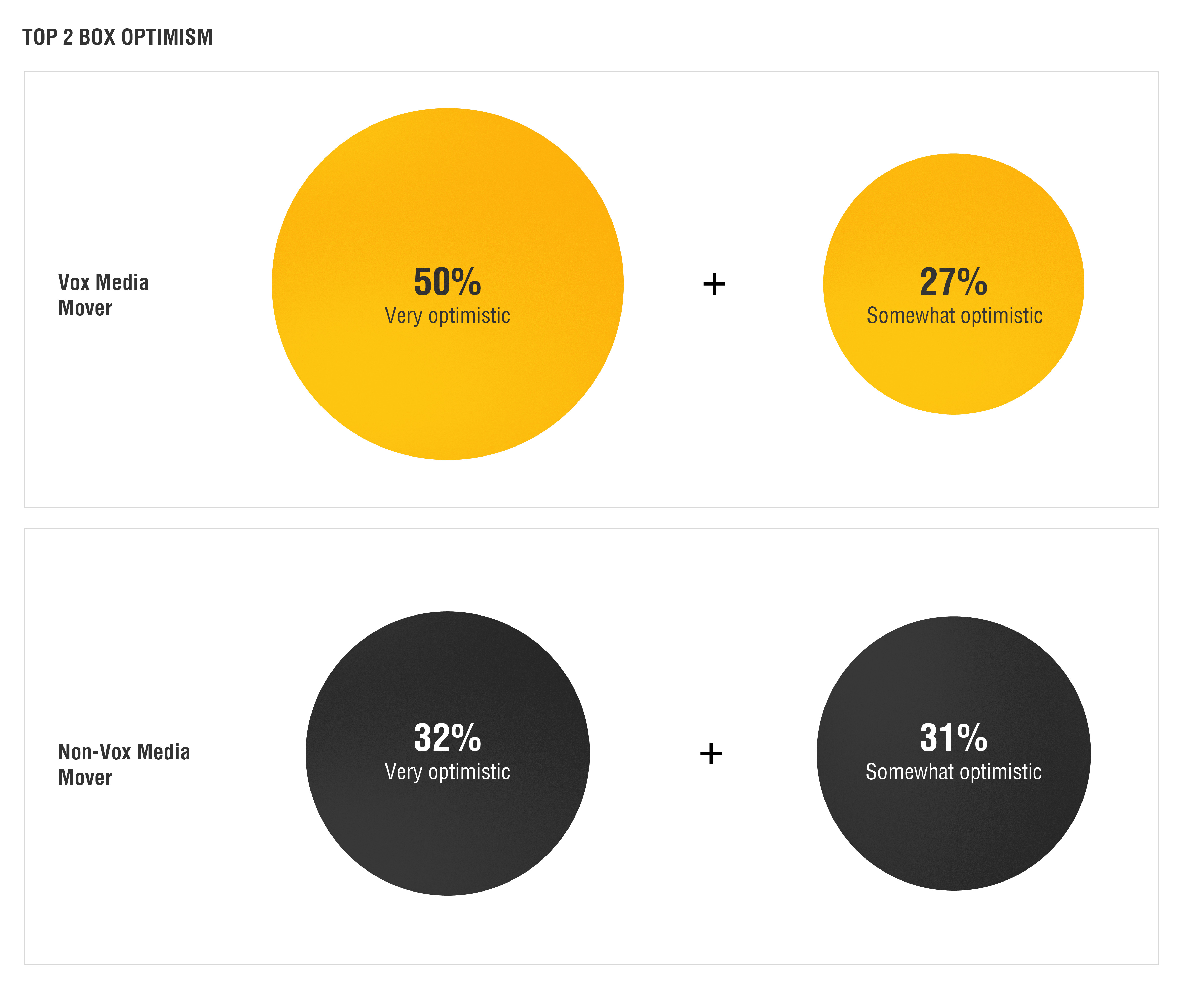

Part of the challenge for marketers will be in identifying high-value movers during this time. When looking specifically at the Vox Media mover, the data would suggest that they are generally happier about a move than the typical mover (63% vs. 47% of Non Vox Media movers). They also enjoy higher optimism about the future:

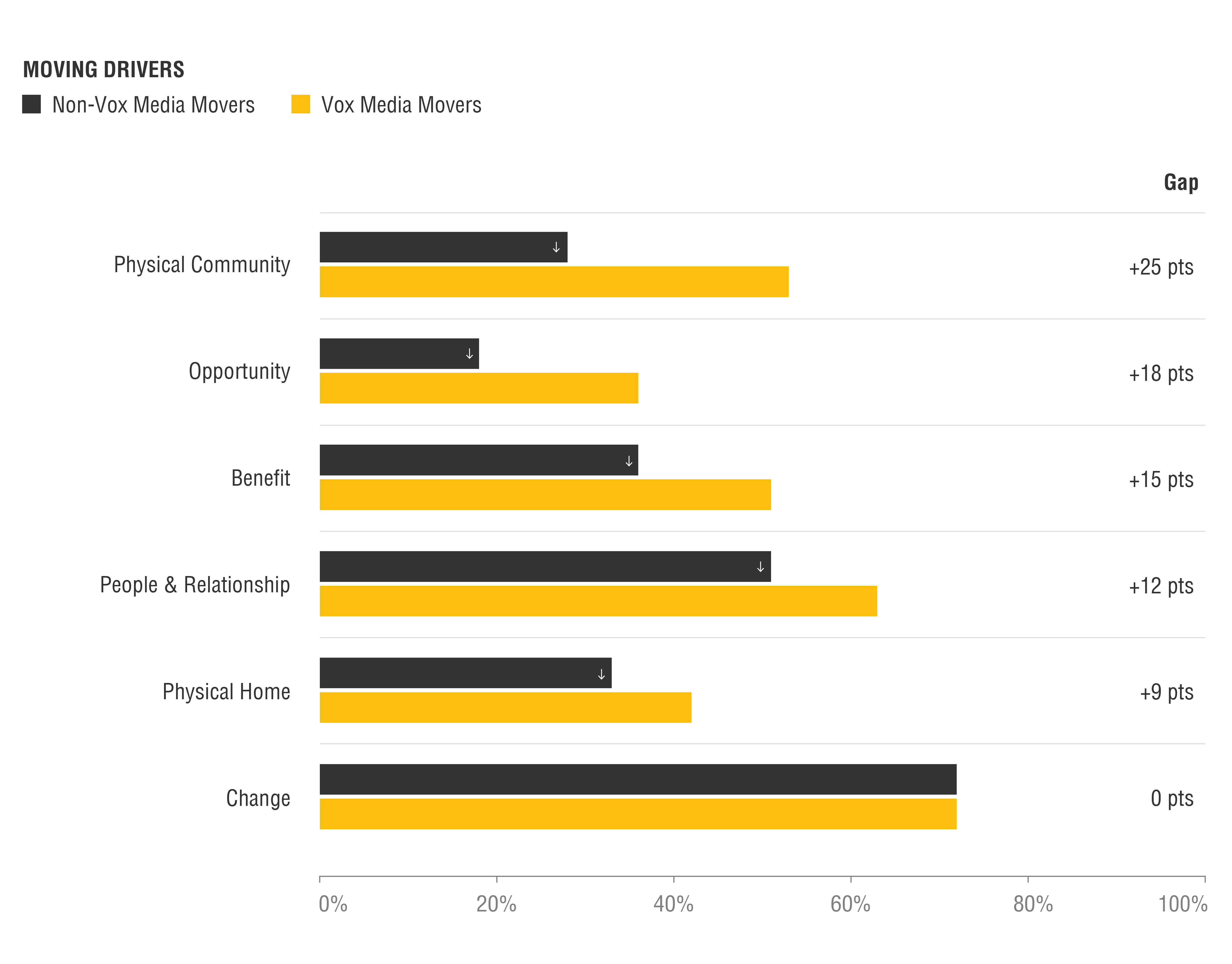

Vox Media movers were more likely to move for bigger life opportunities like a job— and to areas where they could take the greatest advantage of amenities, culture, and community. They also had the opportunity to move closer to family and find larger homes.

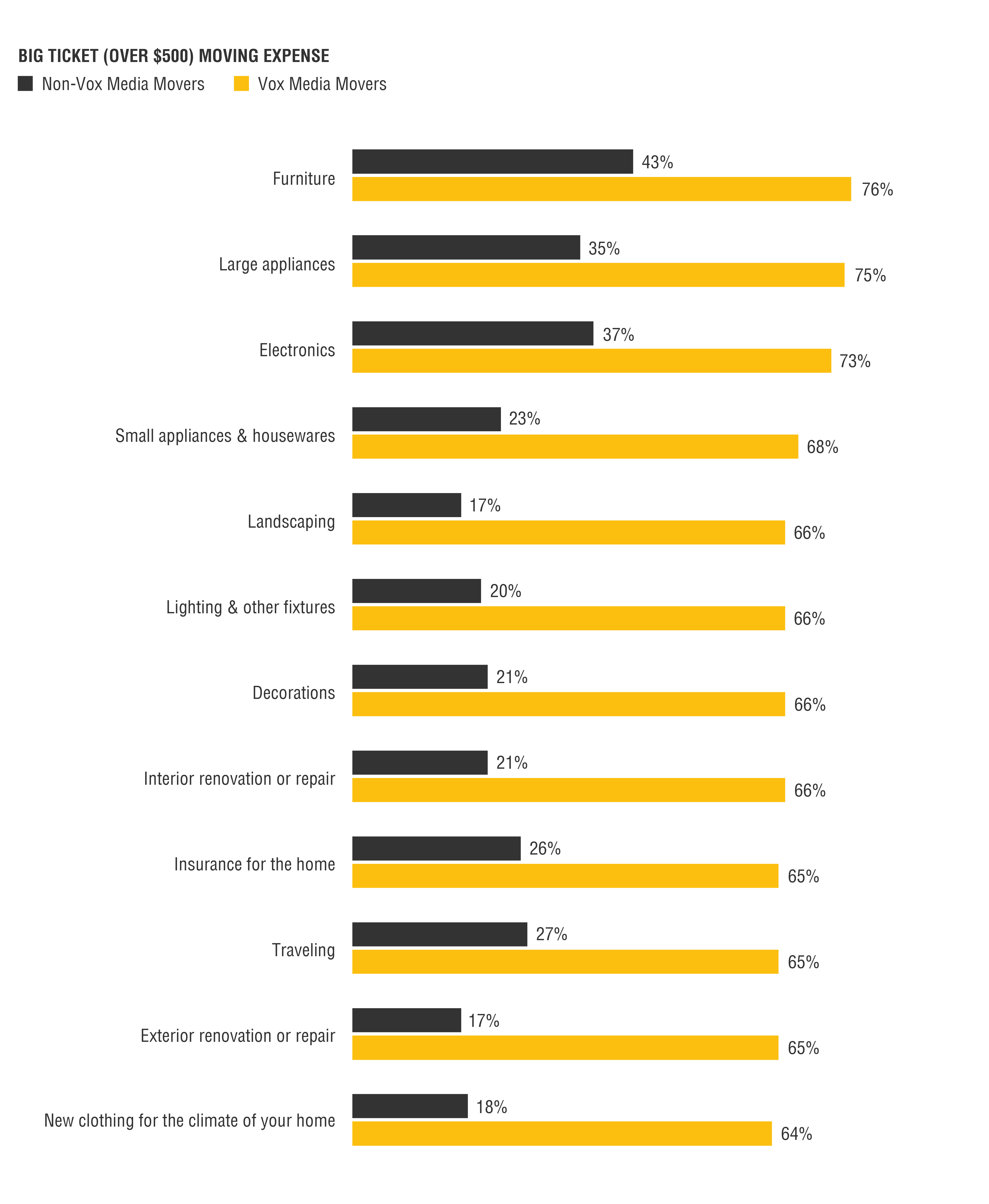

They are nearly 2X as likely to request for “help settling into their new surroundings” versus the Non Vox Media mover (32% vs. 59%). They also have a higher propensity for spending, and are significantly more likely to have spent more than $500 on items like furniture and appliances. This represents an enormous opportunity for brand and marketing programs to help Vox Media movers on their relocation journey.

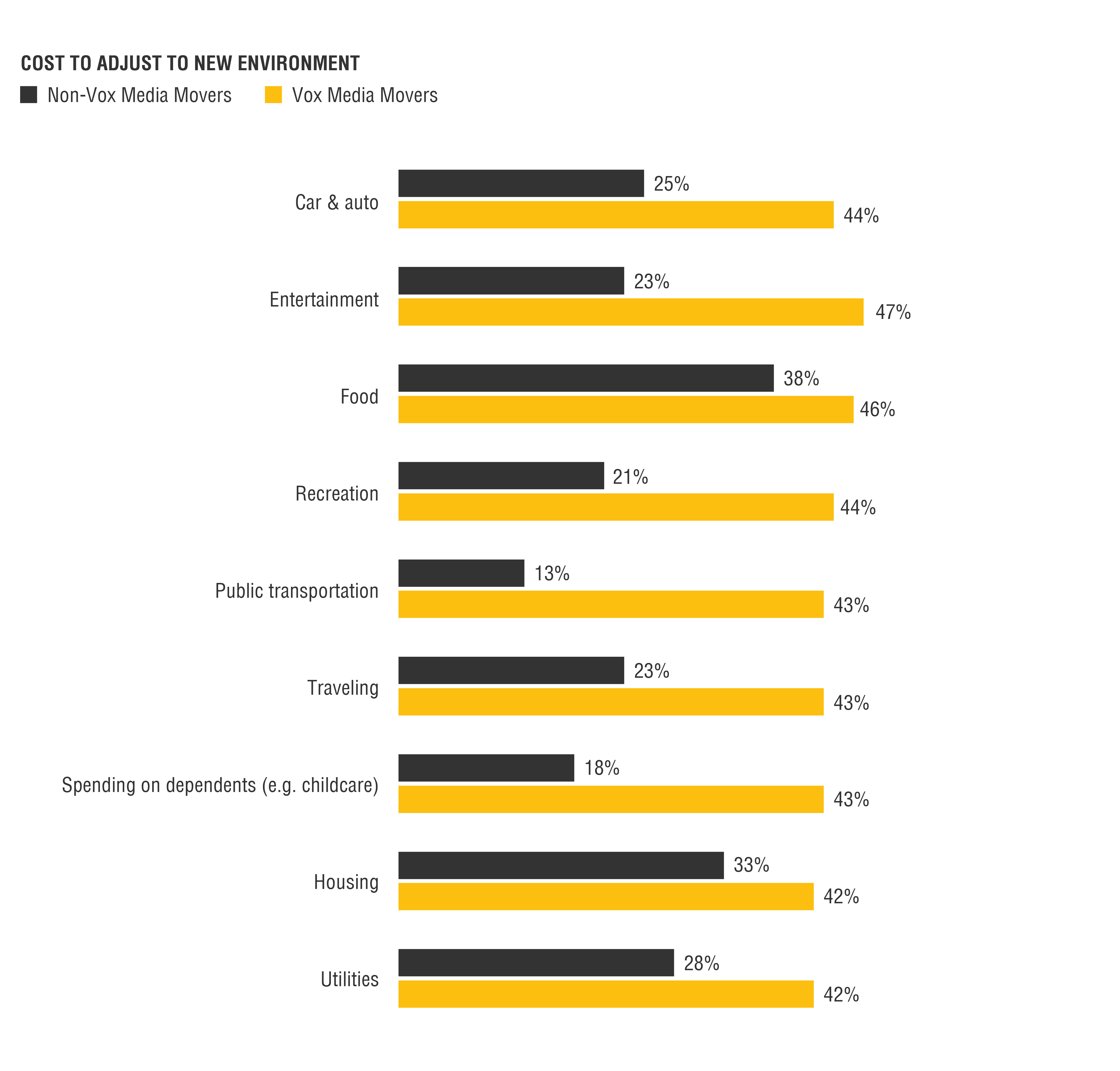

They have also spent significantly more on recreation, entertainment, traveling, childcare, and more.

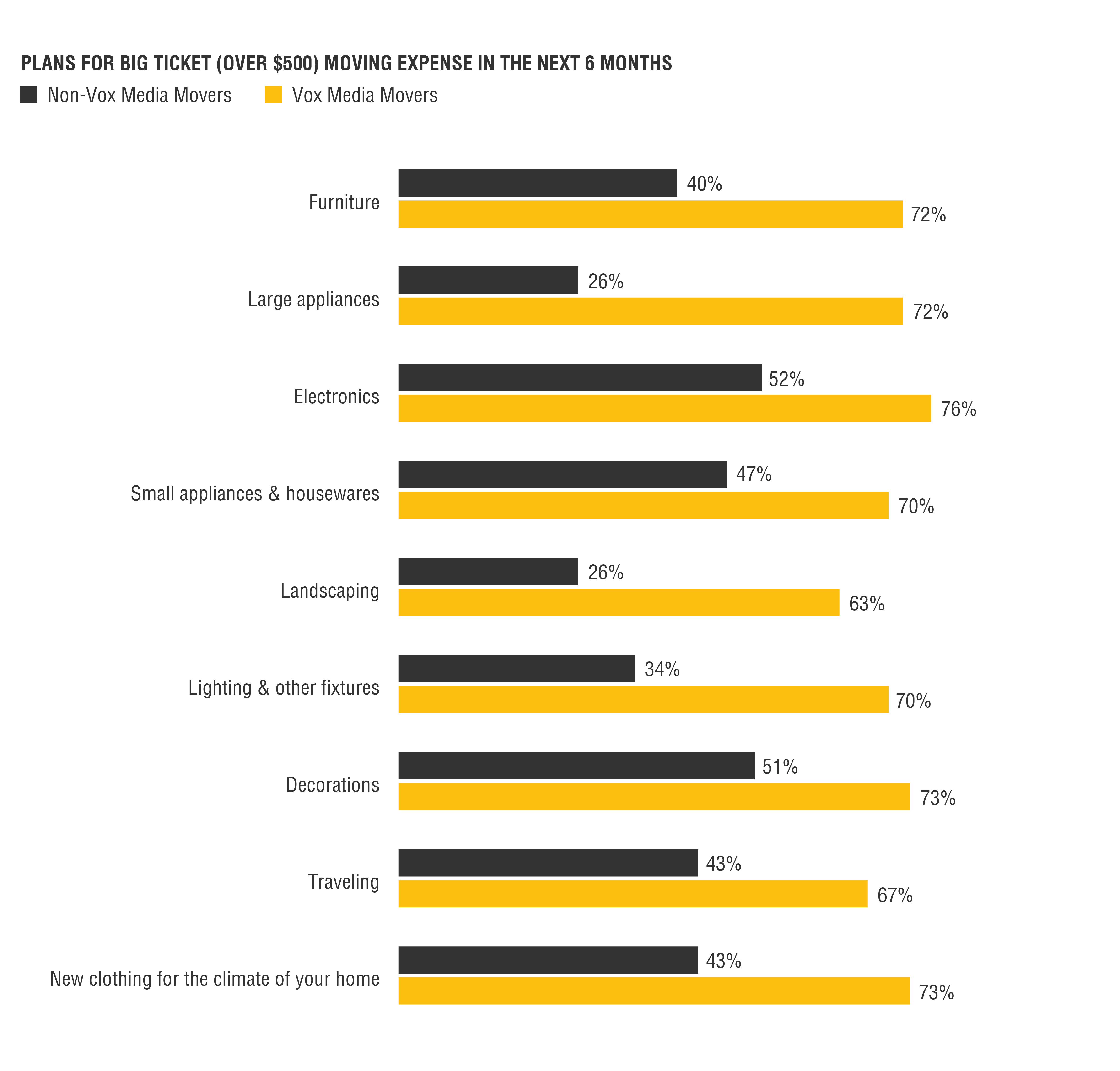

Most importantly, they have a greater appetite for spending in the future. In the next six months, Vox Media consumers plan to make purchases in these same categories at a much higher clip.

That’s good news for marketers as “The Great Relocation” continues to evolve into 2022 and beyond.

Contributors: Edwin Wong and Loren DiBlasi

Corus provides innovative research solutions to top brands worldwide. Its collaborative platform lets teams publish rich visual stories using up-to-the-minute consumer data and AI-enabled insights.